If you are planning to launch a food truck or if you are currently in the process of developing a business plan for your project, then there is no doubt that you are currently wondering how to project your financials in order to better understand the size of the opportunity. If so – congratulations! You’ve come across this article at just about the perfect time because it will help you build a robust financial plan for your upcoming food truck business.

Moreover, if you are planning to raise funding for your Food Truck venture then our financial planning guide will surely help you build a strong financial model to effectively engage with investors and potential partners.

Developing a Food Truck Financial Plan may seem like a very difficult task at first, but don’t worry! With this detailed guide for F&B entrepreneurs we’ll walk you through the process. From creating your financial plan to convincing others that investing in what could be a lucrative idea – our aim is to provide resources so everyone can get on board with the exciting project of launching their very own food truck today!

Food Truck Financial Plan Excel Template

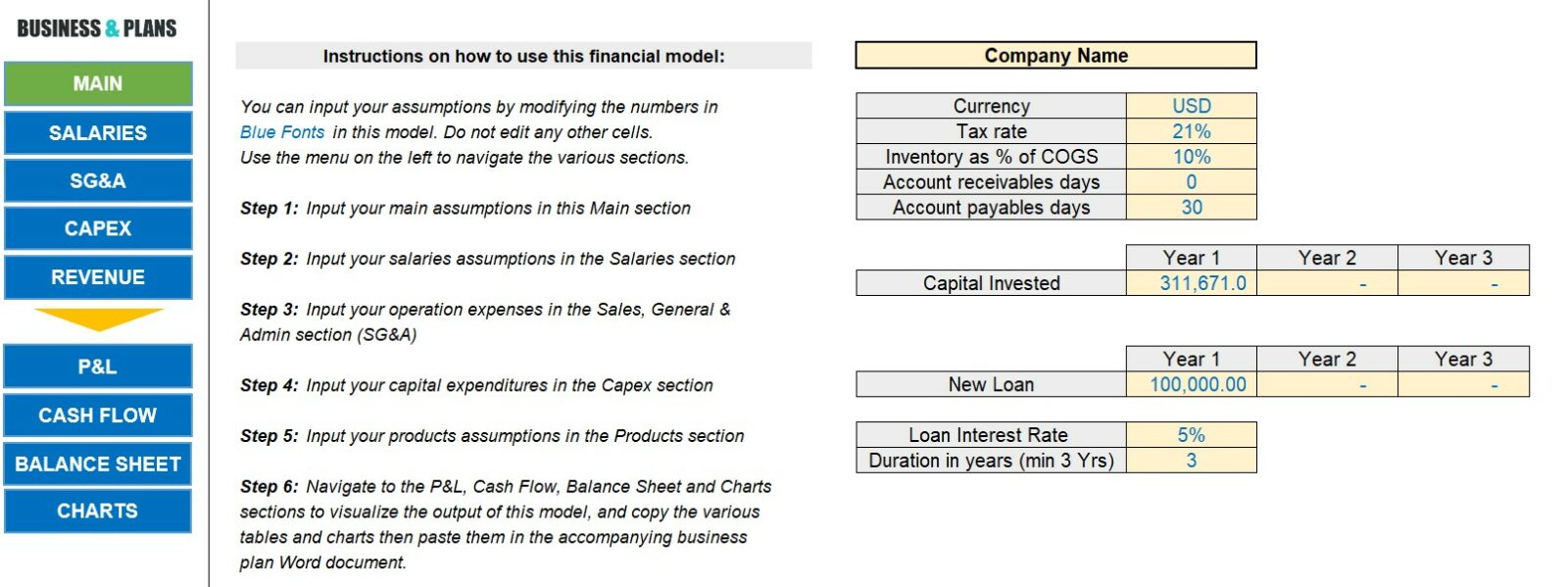

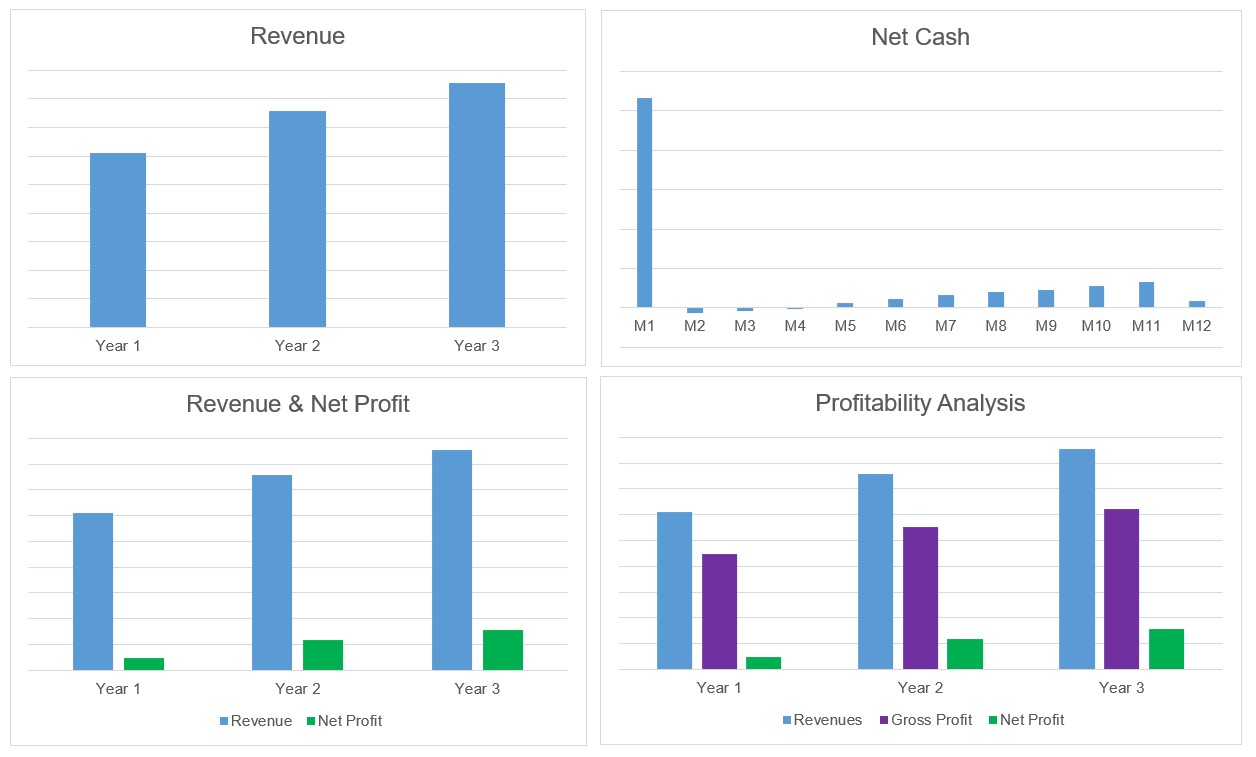

Before we dive in our detailed guide that explains what to include in your Food Truck Financial Plan, you might be interested to check our Food Truck Business Plan Template that includes an automatic and fully customizable pro-forma financial model in Excel tailored to the Food Truck business. Below are a few screenshots to give you an idea.

Our food truck financial plan and very user-friendly and does not require any specific financial expertise. All you need to do is change a few cost and revenue assumptions to tailor the model to your own Food Truck project. Once done, the model will automatically generate for you key financial statements including Income statement, Cash Flow statement and Balance Sheet, in addition to a number of important charts and tables.

The Benefits of Building a Financial Plan for Your Food Truck Project

Identifying start-up costs: A financial plan can help you get a clear understanding of the costs associated with starting a food truck business, such as the cost of the truck, equipment, and inventory. This can help you create a budget and ensure that you have enough capital to get your business off the ground.

Projecting revenue and expenses: Financial projections can help you forecast your expected revenue and expenses, which can help you make informed decisions about pricing and cost control. For example, you may use your financial plan to determine the price point at which your food truck business will be profitable.

Identifying potential funding sources: A food truck financial plan can help you identify potential sources of funding, such as loans or investors, and assist you in creating a pitch to secure funding. A well-prepared financial plan can demonstrate to potential investors or lenders that your business idea is viable and that you are a responsible, organized business person.

Assessing profitability: A financial model can help you determine whether your food truck business idea is financially viable and if you can expect to earn a profit. This can help you decide whether to move forward with your business idea or to consider alternative options.

Helping with ongoing financial management: A solid food truck financial plan can serve as a tool for ongoing financial management, allowing you to track your actual financial performance against your projected financial performance, and make adjustments as needed. This can help you make informed decisions about how to grow your business and manage costs over time.

Now without further delay, let us now go through the main elements of a robust Food Truck Financial Plan.

Food Truck Financial Plan: Costs Forecast

First of all, it is paramount to understand the costs involved in launching a Food Truck business. Cost figures are generally divided into two main categories: Costs Of Goods Sold (COGS or Direct Costs) and Operating Expenses (Opex) and these include Sales, General and Administrative expenses.

Understanding the Monthly Expenses of your Food Truck

The direct costs involved in running a Food Truck include the cost of purchasing raw materials to prepare your food and menu items, such as: food ingredients, condiments, drinks…etc. These cost also include all items you outsource from suppliers such as napkins, straws…etc.

Opex or operating expenses are a different category of costs. Things like salaries, commissary fees, maintenance, licensing and other overhead expenses are usually covered by operating costs. These are more indirect, as they are not directly linked to the food product you sell.

You can calculate your total Food Truck costs by simply adding your COGS and Operating Expenses.

Don’t forget that certain expenses tend to increase over time while others tend to remain stable. For instance, your commissary fees or kitchen rental (in case you are also renting a fixed kitchen) tend to remain the same over time while your employee’s remuneration will probably increase year on year.

Food Truck Financial Plan: Capital Expenditures

Now let us understand the capital expenditures involved in launching a Food Truck business. Capital Expenditures, or simply Capex, are a type of investment you make in order to purchase long-term assets such as the truck itself or some appliances such as your professional grill and fridge. These assets usually have a long term usage and are typically depreciated over many years, unlike Operating Expenses.

Food Truck Financial Plan: Startup Costs

Your startup cost for a food truck are simply the pre-operating expenses and investments you need to make before your project starts generating revenue. These costs include things like buying or leasing equipment, having someone design your brand identity and getting all the licenses needed to operate your food truck. Your startup costs are usually covered by the founder’s initial capital.

Food Truck Financial Plan: Revenue Forecast

After assessing your costs, it is time to forecast how much revenue your Food Truck can make. This step can be a bit difficult because there are many assumptions involved in estimating your revenue. These include understanding the number of customers you might get in a day and the average order values per customers. However, if you conduct a proper market research, you should have no problem making accurate assumption with lower margins of error. This is why understanding your area of operation and target audience is key when planning your food truck business.

To make things easier, let us look at an example. In order to estimate your number of daily customers, you can look at the number of people in a certain age tranche, living in the area surrounding your usual food truck parking spot. For instance let’s suppose there are 20,000 adults between the age of 18 and 50 within a 5km radius from your food truck location, and let’s assume that only 5% of them will visit your Food Truck once a month; this works out to an average of 1,000 monthly customers. Next, let’s assume the average order value per customer to be around 15 USD, this means your food truck will generate a monthly revenue of around 15,000 USD (15 x 1,000). Since you have already estimated the revenue for one month of operation, you only need to multiply this by 12 to forecast you revenue per year.

It paramount however to take into consideration the seasonality linked to your food truck business. Usually, outdoor businesses such as a food kiosk or food truck are expected to do better during summer time when the weather is sunny.

In all cases, it is very important to keep in mind that building a food truck revenue model requires you to make conservative assumptions backed by a solid market survey if possible.

Food Truck Financial Plan: Income Statement or Profit & Loss

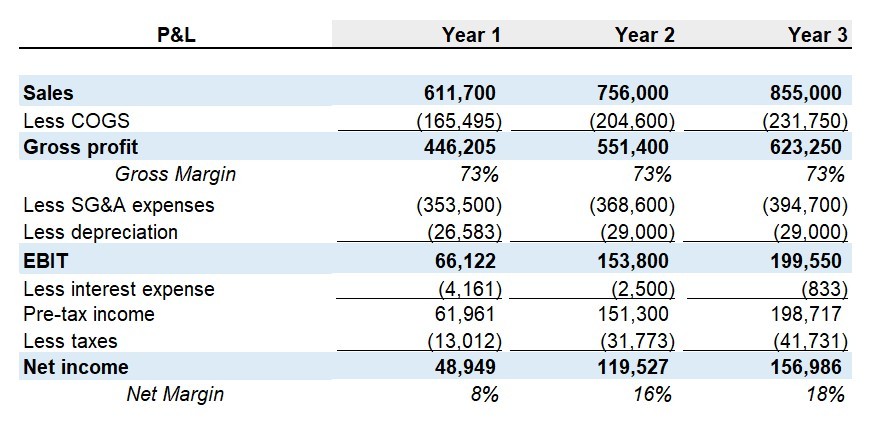

After modeling your Food Truck’s costs and revenues, let’s now tackle the forecast of your income statement also called the profit and loss (or P&L) statement.

The P&L takes your gross revenue for the period (top line) and then deducts your direct costs or COGS to derive your gross profit. Then from the gross profit, you deduct your overhead costs or operating expenses (opex), depreciation and interest payments to derive your net profits before tax. And finally, after deducting the tax charge, you arrive to your net profit (bottom line).

Understanding the Profitability of your Food Truck Business

To put things into perspective, think of the P&L as a series of subtractions applied to your top line or gross sales to find out how much net income your business has really produced. Then, if you divide your net income by your gross sales, you calculate the net margin. A higher net margin means a more profitable Food Truck business.

By using our Food Truck Financial model included with our premium business plan template, you don’t need to worry about building an income statement from scratch. This financial statement is automatically generated once you edit your cost and revenue assumptions, hassle-free.

Food Truck Financial Plan: Cash Flow Statement

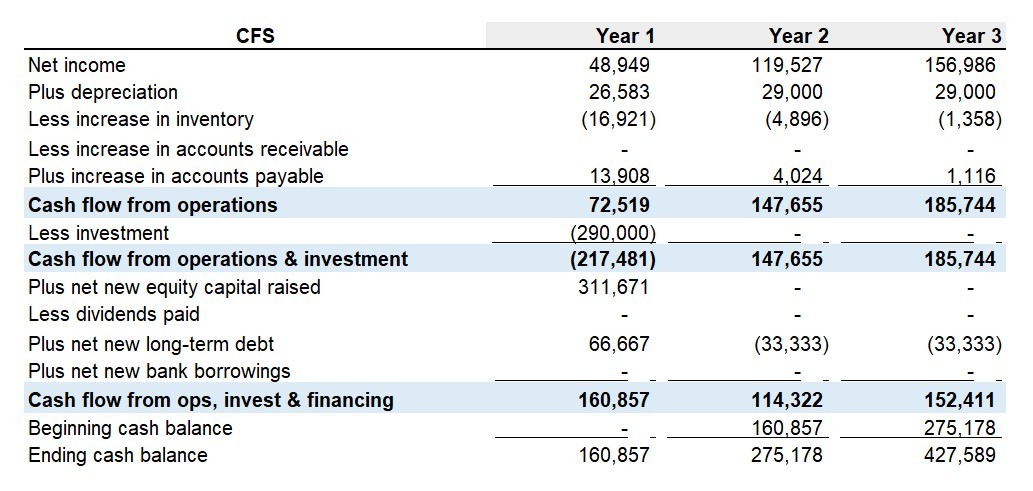

The cash flow statement is, as its name indicates, a summary of the cash movements occurring in your Food Truck business over a certain period.

First, let us clarify the difference between cash and income or expense as many entrepreneurs tend to conflate both terms. The main difference between a cash-flow and an income or expense is timing. To understand the nuance, let’s take an example: Suppose you received from your supplier an order of soda cans with an invoice of 2,000 USD, dated April 14th, the invoice is payable within 30 days. Your accountant will record a direct expense (or COGS) of 2,000 USD in your income statement for the month of April while he will record an operating cash outflow of 2,000 USD for the month of May in your cash flow statement (since you will actually pay the 2,000 USD sometimes in May, before the end of the 30 days period).

The same logic applies to revenues in case you were the supplier of these soda cans since you will record a revenue of 2,000 USD in April (corresponding to the invoicing date) while the 2,000 USD will be actually collected in May in your bank account (reflected in May in your Cash Flow statement).

This means that cash flows do not necessarily follow the same recording date of income and payments. Income and expenses usually follow the invoice date while cash inflows and outflows follow the actual clearing or payment date.

So what is included in a Food Truck statement of cash flows?

A statement of cash flow is a summary of three types of cash flow movements over a certain period:

Cash flows from operating activities: They include cash inflows collected from customer orders and cash outflows that are payments made to pay for COGS, raw materials and external suppliers.

Cash flows from investing activities: Here, cash inflows are money collected from the sale of a certain asset or capex item (such as the sale of your old food truck) and cash outflows are money paid to acquire new assets (such as money paid to buy a new food truck).

Cash flows from financing activities: Here, cash inflows are new capital received from business loans or equity investors and cash outflows are payments made to partners in the form of dividends for example.

Investors focus a lot on the ability of a business to generate solid and tangible cash flows which means that it is not enough to have a profitable Food Truck, what’s even more important is to grow a food truck venture that generates consistent and substantial cash flows.

If you use our Food Truck Financial plan in Excel included in our premium Food Truck Business Plan package, you will be able to automatically generate a detailed cashflow statement after updating your cost and revenue assumptions.

Food Truck Financial Plan: Balance Sheet

The balance sheet is another important financial statement. It summarizes the assets and liabilities of your Food Truck at a certain point in time (typically at the end of the year).

The balance sheet is divided in two sections. The first one lists all your short-term assets (cash and equivalents, inventory, receivables…etc.) and long-term assets (property, plant and equipment less accumulated depreciation…etc.)

The second section lists all your current liabilities (account payable, bank notes payable…etc.), long-term liabilities (bank debt, business loan…etc.) and shareholder’s equity.

The balance sheet can be summarized using the following formula:

Assets = Liabilities + Equity

By using our Excel Food Truck Financial plan included in our premium Food Truck Business Plan package, you will be able to automatically generate a detailed balance sheet after updating your cost and revenue assumptions.

Food Truck Financial Plan: Conclusion

This guide has provided you with a general overview of how to build an effective financial plan for your Food Truck project. Remember that a serious Food Truck business plan must include a solid financial plan with robust cost and revenue models. You can totally build this from scratch. But if you are short on time and wish to avoid many potential mistakes, we highly recommend you use our detailed Excel financial model included in our Food Truck Business Plan template.