Starting a gym can be an exciting and rewarding venture, but it also requires careful planning and financial management. The fitness industry is a rapidly growing market, but with so many gyms and fitness centers to choose from, it’s important to have a solid gym financial plan in place to ensure the success of your project. A well-crafted gym financial plan can help you identify potential financial issues, set realistic goals and create a roadmap for achieving them.

In this blog article, we will discuss some of the key financial considerations for a gym business, including cost structure, capital expenditures, startup expenses, revenue projections, break-even analysis, profit and loss forecast, cash flow forecast and balance sheet forecast. Whether you’re a seasoned gym owner or a first-time entrepreneur, this guide will provide you with the tools and knowledge you need to create a financially sound gym business.

Gym Financial Plan Template in Excel

A little disclaimer before we start: If you’re planning to start your own gym and wondering where to begin, we invite you to consult our automatic Gym financial plan spreadsheet in Excel included with our ready-made gym business plan package. We have done all the work already. All you need to do is modify a few assumptions and edit these documents and you end up with an investor-grade gym business plan with detailed financials. This is the most cost-effective solution to create a gym business plan in record time.

For now, let’s discover together what are the key components of a winning gym financial plan.

Cost Forecast for a Gym Business

The cost structure of a gym business includes several key components, including equipment, rent or mortgage, staffing and marketing.

Understanding Your Gym’s Monthly Expenses

Let’s understand each cost item recurrent in your gym on a monthly basis:

- Rent or mortgage payments for a gym location is usually a significant expense. The location you choose will impact the cost, with prices varying depending on the size of the space and the area it is located in. It’s important to consider the potential number of members you can serve in a given location and the corresponding cost.

- Salaries are another major expense in a gym business. You will need to budget for salaries and benefits for trainers, front desk staff and other business personnel if needed (social media and marketing staff for instance). Keep in mind that the number of employees you need will depend on the size of your gym and the level of service you expect to offer.

- Marketing and advertising is another significant cost to consider. Running a successful gym means you need to invest in advertising and promotion, developing a website and building a strong social media presence. You might also do SEO, SEM and PR campaigns.

- General and Administrative expenses: Finally, let’s not forget other expenses such as utilities, insurance, accounting and legal fees…etc.

- Equipment is one of the largest upfront expenses for a gym and unlike all the other costs listed above, this isn’t usually a monthly expense. Some gyms opt for new equipment, while others purchase used equipment at a lower cost. We will further develop these types of expenditures in the next section.

It is important to note that your gym costs can vary widely depending on the location, size and type of gym you are starting. Now let’s talk about capital expenditures.

Gym Financial Plan: Capital Expenditures

Capital expenditures, also known as CapEx, refer to the funds used to acquire or improve long-term assets, such as equipment, real estate or technology. In a gym business, capital expenditures usually include the cost of buying or leasing equipment, renovating or building a gym location and installing technology such as software or security systems.

Here are some examples of common gym equipment that you may consider purchasing:

- Treadmills: These are popular cardio machines that simulate running or walking.

- Ellipticals: They provide a low-impact cardio workout that simulates running or stair climbing.

- Stationary bikes: These machines provide a cardiovascular workout and are often used for indoor cycling classes.

- Rowing machines: These machines provide a full-body workout and are popular for cardio and endurance training.

- Weight machines: These machines are designed to target specific muscle groups and can include machines for the chest, back, legs, arms…etc.

- Free weights: They include dumbbells, barbells, and weight plates, and are used for isolated or strength training exercises such as bench press, squats and deadlifts.

- Mats: These are used for stretching and exercising on the floor.

- Medicine balls: These weighted balls can be used for a variety of exercises such as slams, throws and core work.

- Plyometric boxes: They are used for plyometric exercises, such as box jumps and step-ups.

When planning your gym capital expenditures, it is important to consider the long-term value that the asset will bring to your business. For example, investing in high-quality treadmills may be more expensive in the short-term, but it can provide a better return on investment in the long-term by reducing maintenance costs and increasing the satisfaction of your members.

It is also important to consider the financing options available for your gym CapEx. Some gyms may choose to finance their capital expenditures through loans or leasing, while others may choose to use their own savings or raise funds through investors.

In summary, capital expenditures are an important aspect of a gym business’s financial plan and should be carefully considered in relation to the long-term value and timing of the asset, as well as the financing options available. It’s important to have a good projection of the cash flow and to plan for contingencies such as unexpected repairs or equipment replacement in the future.

Startup Expenses for a Gym Business

Startup expenses refer to the initial one-time costs associated with getting your gym business off the ground. These can include pre-operating legal and accounting fees, marketing and advertising costs needed to launch the gym and setting up a website or other online presence. Purchasing your gym equipment or investing in the location itself are also major components of you initial startup investment.

It’s important to have a detailed budget that includes both startup costs (these are expensed) and capital expenditures (these will be capitalized as assets for the business) in order to ensure that you have the necessary funds to get your gym up and running.

Gym Revenue Projections

Projecting revenue is an important aspect of any business’s financial plan, and a gym business is no exception. Revenue projections can help you determine how much money you can expect to bring in and how much you will need to invest in order to turn a profit.

To project the revenue of your gym business, you will need to consider several factors including:

- Gym membership fees: This is your primary source of revenue and it’s important to determine how much you will charge for different types of memberships (monthly, yearly or pay-as-you-go).

- Personal training and classes: You will also most likely offer personal training and group fitness classes so it’s important to determine how much you will charge for these services.

- Merchandise sales: Some gyms also sell merchandise such as supplements, workout clothes and gym accessories, so it’s important to determine how much revenue you can expect from these sales.

- Other potential revenue streams: Other sources of income for gyms include advertising, sponsorships and partnerships with other brands.

Remember that revenue projections are not always accurate and unexpected costs can arise during the operation of the business, so it’s important to have a contingency plan in place and to regularly review and update your projections as your gym grows.

It’s also important to know your target market and the competition in the area. This will help you a lot with setting your pricing and offering a truly attractive value proposition.

Finally, let’s not neglect the effect of seasonality inherent to the gym business. Typically, gyms see an increase in membership in the beginning of the year as people make New Year’s resolutions to get in shape. This is often referred to as the “January effect”. Additionally, gyms also tend to see an increase in usage right before the summer season as people want to get in shape for the beach.

Conversely, gyms tend to see a decrease in membership and usage during the holiday season and in the middel of the summer when people are on vacation. Understanding and planning for these seasonal patterns is crucial to mitigate these variations in terms of revenue and profitability.

Break-even Analysis for a Gym Business

A break-even analysis is a financial tool that helps you determine the point at which your gym will begin to turn a profit. In other words, it can help you understand how many members you need to sign up in order to cover your expenses.

The first step of a break-even analysis involves calculating the total fixed costs (those that don’t change with the level of business) and variable costs (those that change with the level of business). Fixed costs for a gym business include rent, insurance and salaries, while variable costs include utilities, supplies, and equipment repairs.

Once you have calculated your total fixed and variable costs, you can use this information to determine your break-even point. The break-even point is the point at which your revenue and costs are equal. This can be calculated by dividing the total fixed costs by the difference between the price of a membership and the variable cost per membership (also called contribution margin).

For example, if your fixed costs are $50,000 and the average variable cost per annual membership is $50, and you charge $500 per annual membership, your break-even point would be approximately 112 annual members (50,000 / (500 – 50) = 111.11). This means that you should sell 112 annual memberships in order to cover your costs and begin to turn a profit in a given year.

Please note that the break-even analysis is based on certain assumptions about costs and prices and it’s not always accurate. Also, remember that the gym business is seasonal, so the numbers may change depending on the time of the year.

The break-even analysis is an important tool for understanding the financial viability of your gym business and it can help you make informed decisions about pricing, membership goals and marketing strategies. It can also help you identify areas where you can cut costs in order to reach profitability faster.

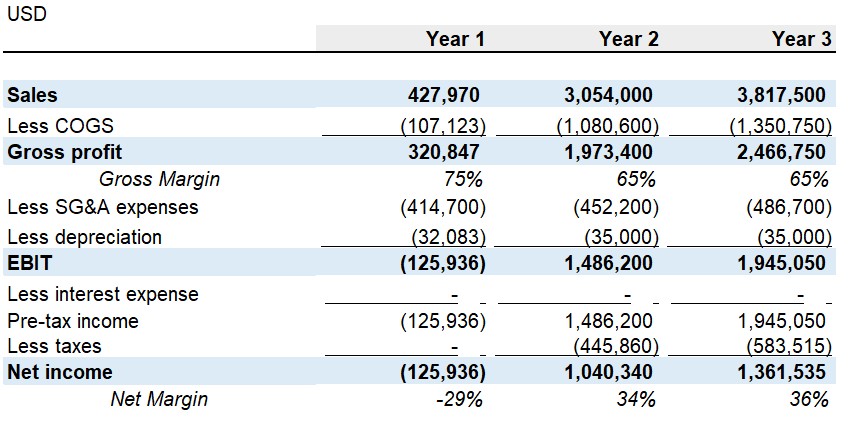

Profit and Loss Forecast for a Gym Business

A Profit and Loss (P&L) forecast (also called Income Statement) is a financial tool that projects the expected revenue and expenses of a business over a given period of time, typically a year. It’s an important part of a gym’s financial plan, as it can help you understand how much money you can expect to make or lose, and how much you will need to invest in order to become profitable.

To create a P&L forecast, you will need to gather information about your projected revenue streams, costs and expenses. This information can be taken from your revenue projections, break-even analysis and budget.

Understanding Your Gym’s Profitability

It is a good idea to think of your gym’s P&L as a series of deductions that you apply to the top line (or revenue). The projected income statement will then have the following sections:

- Revenue: This section shows the total revenue from all sources, including membership fees, personal training and classes, merchandise sales and other potential revenue streams.

- Cost of goods sold (COGS): This section shows the direct costs associated with producing the goods or services sold, such as merchandise, consumables and supply costs, or even the fees paid to class instructors.

- Gross profit: This section shows the total revenue minus the COGS, which is the profit earned before accounting for other operating expenses.

- Operating expenses: This section shows the expenses associated with running the business, such as rent, salaries, advertising, depreciation (linked to using the gym equipment) and other general and admin costs.

- Net profit: This section shows the total profit (or loss) after deducting all expenses. You can then divide this number by the Revenue and you get your Net Margin (Expressed in percentage). Highly profitable gyms have a high net margin.

It’s important to note that the P&L forecast is based on certain assumptions and predictions, and it’s not always accurate. The actual results may differ from the forecast.

Regularly reviewing and updating your gym Profit and Loss forecast is important to ensure that the business is on track to meet its financial goals.

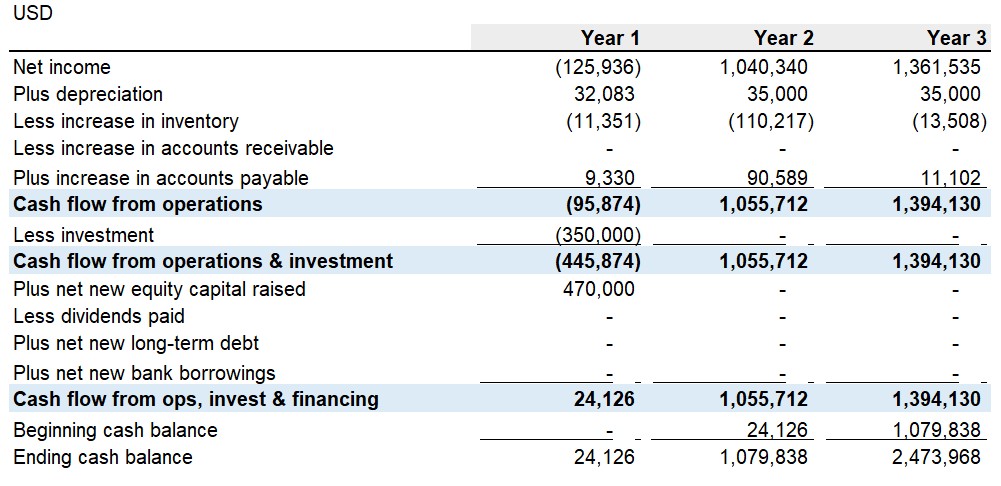

Cash Flow Forecast for a Gym Business

Cash flow is the movement of money into and out of your gym business. Cash inflows come from membership fees, personal training and classes, product sales and other revenue sources. Cash outflows go towards expenses such as equipment purchases, rent, salaries, utilities and ad expenses.

A cash flow forecast is a projection of these inflows and outflows over a given period of time, typically a quarter or year. It is an important tool for understanding the financial health of a business, as it helps you identify when cash will be available to pay bills and invest in growth and when additional funds may need to be raised.

Cash flow can be broken down into three main categories:

- Cash flow from operating activities represents the cash generated or consumed in the day-to-day operations of the gym. This includes cash received from customers, as well as cash paid out for expenses such as rent and salaries. A positive cash flow from operating activities means that the business is generating more cash from its operations than it is using.

- Cash flow from investing activities shows the cash generated or used in the acquisition or disposal of long-term assets, such as a gym equipment or other CapEx item. This can include cash received from the sale of assets, as well as cash paid out for the purchase of new assets.

- Cash flow from financing activities is the cash movement related to the financing of the gym, such as through the issuance of equity or the taking on of debt. This can include cash received from investors or bank loans, as well as cash paid out to shareholders in the form of dividends or loan payments.

Regularly reviewing and updating the cash flow forecast is important to ensure that your gym has enough cash on hand to meet its obligations and capitalize on new opportunities.

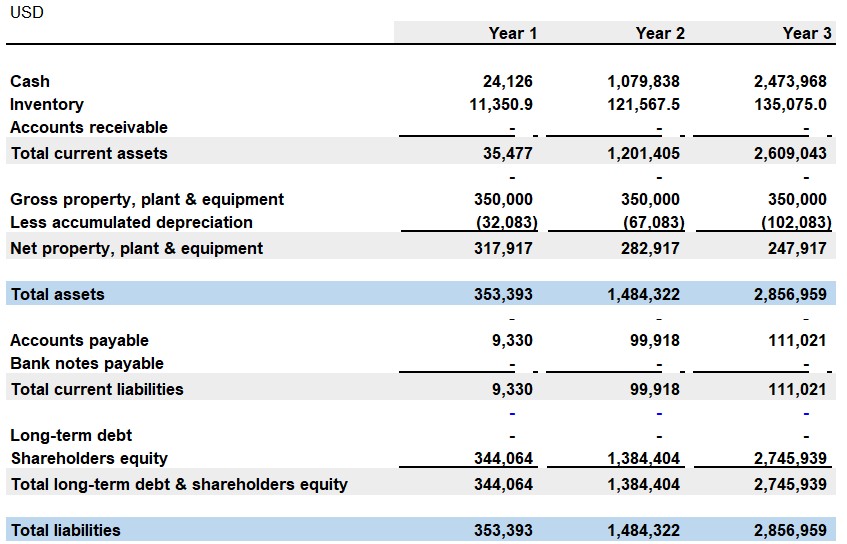

Gym Balance Sheet Forecast

A balance sheet forecast is a projection of your gym’s assets, liabilities and equity over a certain period of time, typically a month, quarter or year. It provides a snapshot of your company’s financial position at a specific point in time.

The balance sheet is divided into two sections: assets and liabilities. Assets are what a business owns, such as cash, inventory, equipment and property. Liabilities are what a business owes, such as loans, credit card debt and accounts payable. The difference between assets and liabilities is known as equity, which represents the owners’ stake in the business.

A balance sheet forecast helps to identify potential financial issues, such as an over-reliance on debt or a lack of cash reserves within your gym business. It also helps you identify areas where you need to invest in order to grow, such as purchasing new gym equipment.

Gym Financial Plan: Conclusion

In this detailed guide, we have discussed the main financial considerations for a gym business but it is important to remember that every business is unique, and the financial needs of one gym may be different from another. Careful research, planning, and budgeting are essential to ensure that your gym project is financially viable and sustainable.

If you wish to take things further, then we recommend purchasing our ready-made gym business plan package that includes a pre-written business plan document in Word and an automatic financial plan in Excel tailored to the gym business. Editing and customizing these documents will only take you a few hours and our promise is that you will end up with a robust and compelling gym business plan with detailed financials. Don’t worry, no particular business or financial expertise is needed.