How much does it cost to open a new restaurant? What kind of information you need to come up with a financial forecast for your new venture? And just how do you create a professional restaurant business plan with financials?

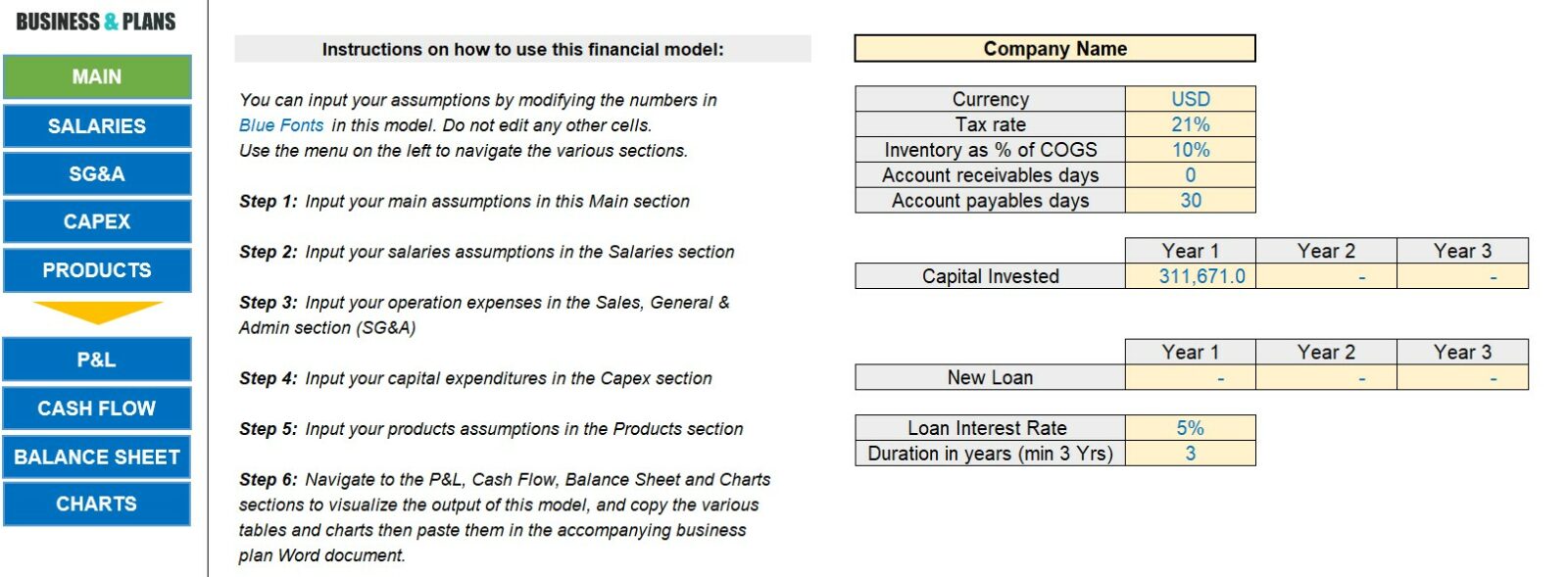

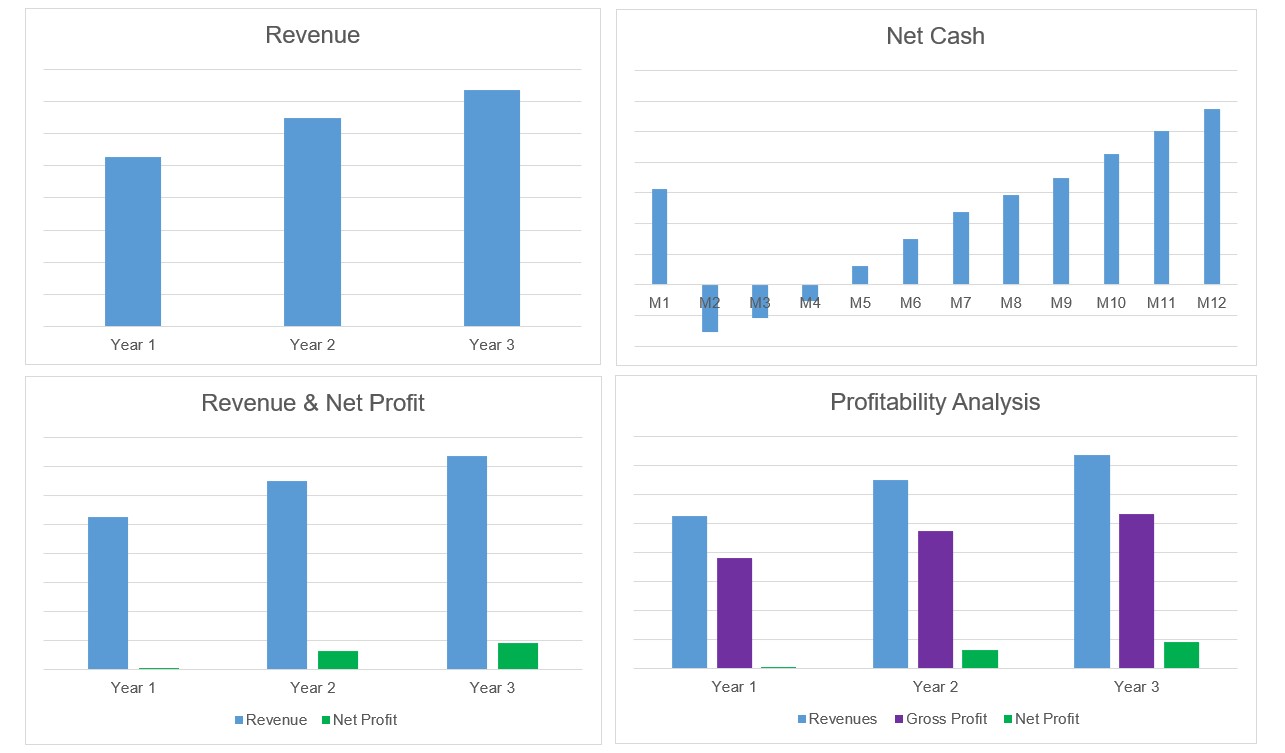

These questions seem difficult to answer at first but creating a Restaurant Financial Plan is actually not that hard — and we’ll show you how to go about it — but it requires some research, patience, and time. If you would rather like to simplify the entire process, may we suggest you have a look at our Restaurant Business Plan template? The template has a fully automatic and customizable financial model in Excel designed specifically for the Restaurant business. Here are a couple of screenshots to give you an idea:

Some of the main highlights of our Restaurant Business Plan template are as follows:

- It is extremely user-friendly, allowing you to create a professional financial plan with just a few clicks

- No financial expertise is required, nor do you need to do any research. Simply, feed in the cost and revenue assumptions for your business model — and our financial model will do the rest. Based on the information provided by you, it will automatically generate important financial statements. These include Cash Flow statement, Income Statement, and Balance Sheet. Plus, it will generate several tables and charts to provide great data representation and make financial analysis readable and easy to follow.

Coming back to building an effective financial plan for your project, this guide is all you need. We’ll walk you through all the key elements of a comprehensive Restaurant Financial Plan. First, let’s have a look at the key benefits of creating a robust financial plan for your upcoming F&B venture.

The Benefits of Creating a Financial Plan for your Restaurant Project

First, it can help you secure funding. When approaching potential investors or lenders, they will want to see that you have a solid plan in place showing how you will use their money and make a profit. A well-researched and detailed restaurant financial plan can give them the confidence they need to invest in your F&B project.

Second, a financial plan can help you make better decisions about your restaurant. It can help you identify potential financial risks and opportunities, and make adjustments accordingly. For example, if your financial plan shows that certain menu items are quite costly compared to others, you can make the necessary changes to improve profitability.

Third, it can help you manage your cash flow. A restaurant financial plan can help you forecast when cash will be coming in and going out, allowing you to better manage your finances and avoid any unexpected cash flow problems. Remember, cash is a key element that can make or break the success of your F&B business, but more on that later.

Finally, a financial plan helps you set and achieve financial goals for your restaurant. It can give you a clear picture of where you want to be financially in the short and long term and help you create a roadmap to getting there.

In summary, building a financial plan is crucial in order to successfully navigate the challenges and opportunities of running a restaurant business.

Let’s now have a look at the first key element of a restaurant financial model: your cost structure.

Restaurant Financial Plan: Costs Forecast

How much will it cost you to run your restaurant business? This is the first question you need to answer. Figuring out the involved costs can be simplified by following the next steps: Start by dividing your costs into two categories: Costs of Goods Sold (also referred as Direct Costs or COGS) and Operating Expenses (usually referred simply as Opex).

So, what falls in the category of Direct Costs/COGS? It includes the cost of buying the raw materials and the cost of preparing the different food items in your menu. These include the cost of food ingredients, raw vegetables, meat, condiments, etc. You should also include non-food items that you purchase from various suppliers, such as paper and cloth napkins, straws, and any other consumables. These expenses are usually “variable costs” as their monthly figure tends to vary with the amount of customers you receive.

On the other hand, operating expenses (Opex) include things such as salaries, rent, utilities, advertising, and all other overhead expenses you will incur. These expenses are rather indirect, since they are indirectly related to what you sell. You can also think of them as “fixed costs” since they tend to remain stable month after month. Nevertheless, they are just as important as your COGS, so make sure you include every operating expense that you’re likely to incur.

Now that you have determined the Direct Costs and Operating Expenses, it’s time to calculate the total cost of running your restaurant business. Here’s the formula:

Total Cost = Direct Costs + Operating Expenses

Keep in mind that while certain expenses will invariably go up over time, other expenses may remain stable. A case in point is the rent, which is not likely to change on year-to-year basis. On the other hand, your employee’s salary will probably increase every year.

You might think we have missed a third category of costs related to buying equipment such as your restaurant’s kitchen appliances or furniture, but that’s not the case. From a financial perspective, these types of expenditures are actually considered types of investments rather than expenses. Check the next section for more details.

Restaurant Financial Plan: Capital Expenditures

Now, let’s have a look at the capital expenditures (Capex) that are involved in a Restaurant business. Simply put, capex include all the long-term investments you make to launch and run your restaurant business. By long-term investment, we mean all assets that have a useful life of 12 months or more. Not only these assets have long-term usage, but their value typically depreciates over the years. They are not usually considered as operating expenses or COGS.

Restaurant Startup Costs

Now what are the startup costs involved in launching a restaurant? Well, the startup costs for a restaurant are simply the investments associated with starting it as well as all the expenses that are necessary for running the restaurant on a day-to-day basis until it breaks-even and becomes self-sustaining. Example of essential startup costs include leasing or buying equipment, obtaining all the required licenses, paying rent, paying restaurant employees, and stocking up on ingredients. Generally speaking, these costs are covered by your initial capital.

Restaurant Financial Plan: Revenue Forecast

Once you’ve assessed the startup costs, you should figure out the revenue your Restaurant business is likely to make. Predicting the revenue may look like a daunting task at first, as it involves many assumptions, like how many customers may visit your restaurant daily on average, the average dollar spent by each customer (average order value), etc. However, a thorough research can help you make these assumptions with a fair degree of accuracy. For this reason, it’s important that you understand your target audience, their spending habits, and the area of your operation. The more research you do and the more data you have to go by, the easier it becomes to make an accurate sales forecast.

Let’s see how this works with the help of an example.

Let’s say you want to predict how many customers will visit your venue on a given day. To be able to do this, you must first know your target audience. For simplicity’s sake, let’s assume your potential customers are all those who are between the age of 20 and 50 and living within a 5 km radius of your restaurant. Let’s further assume your target audience size is 30,000, out of which you expect 4% to visit your restaurant once a month. So, in a month, you will get 1,200 customers. Suppose each customer spends $20 on average, this works out to $24,000 in revenue a month. Continuing with this, you can easily calculate your expected annual turnover, which will be $288,000 (12 x 24,000).

Of course, given the nature of the restaurant business, you also need to factor in certain special scenarios, such as holidays, events, cold or hot weather, etc. Generally speaking, you are likely to do more business during holidays and events. Likewise, a stretch of cold season might lead to more people visiting your warm and cozy restaurant as outdoor activities become more difficult.

For an accurate sales forecast, it’s important that you undertake a thorough market survey and rely on past historical data if available.

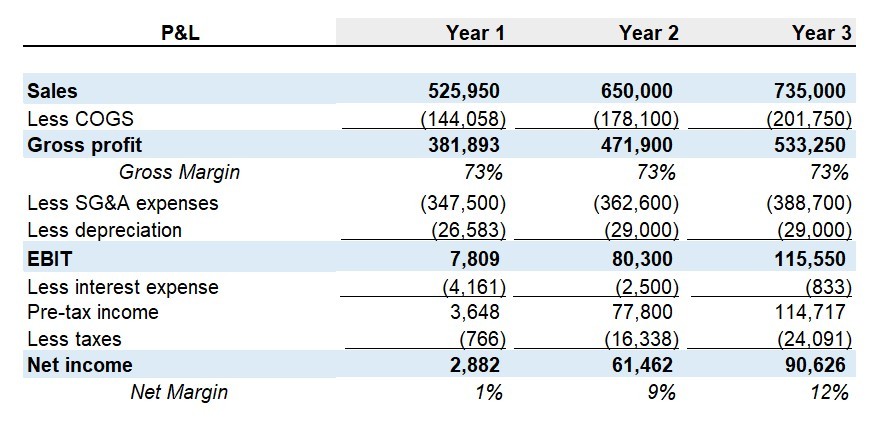

Restaurant Financial Plan: Income Statement or Profit & Loss

Forecasting the Income Statement, which is also referred to as the Profit and Loss statement, or simply the P&L statement, requires a bit of math. But worry not, we are talking about basic, simple math!

First, you must establish the gross revenue for a specific period. Next, deduct the COGS (or direct costs) to determine the gross profit. Once you have this figure, deduct all your operating expenses and other payments from it to calculate the net profit before tax (that is, your restaurant’s business profit before you have paid the income tax). Finally, deduct the amount of tax you’ll pay from the last figure to calculate the net profit, also referred to as the “bottom line”.

Worried about all these calculations? If so, consider using the Restaurant Financial model which comes with our ready-made Restaurant business plan template. The tool will automatically generate your P&L statement once you have entered your revenue and cost assumptions.

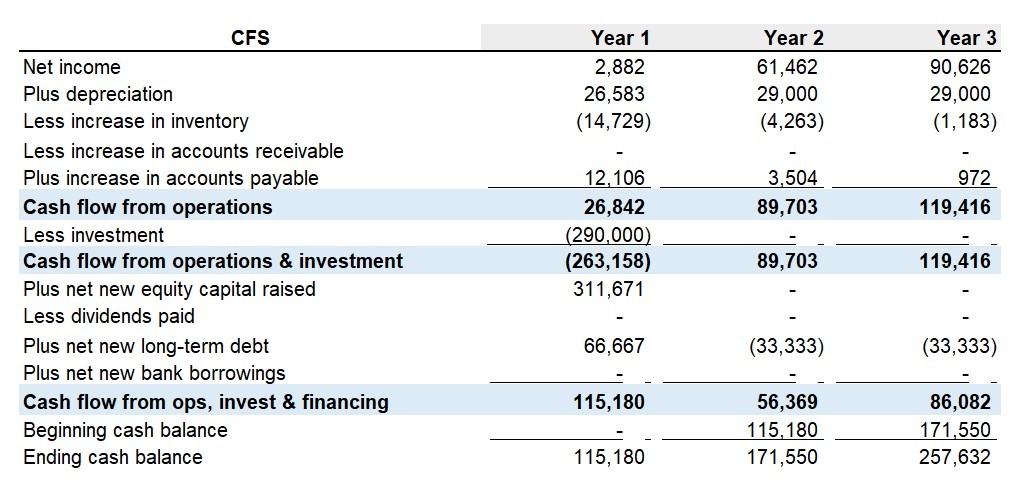

Restaurant Financial Plan: Cash Flow Statement

The cash flow statement (CFS) predicts the amount of cash entering and leaving your restaurant business in a given period.

Before we look at what’s generally included in a CFS for a restaurant, let’s get one thing straight. There is a difference between cash flow and expense or income, even though some people conflate these terms. The main difference between these is in “timing”. Let’s take up an example to understand the finer subtleties clearly.

Let’s say you ordered soda cans worth $1,500 from your supplier on September 20th. However, the invoice needs to be processed in 30 days. Upon receiving the order, your accountant is going to enter a COGS (or direct expense) of $1,500 in the September’s income statement. However, it’s in the CFS of October that he’ll enter a $1,500 operating cash outflow. That’s because, you will actually pay the vendor $1,500 in October since you have 30 days to pay the amount due.

When it comes to revenues, the same logic is applied. Suppose you supply soda cans worth $1,500 in September to an establishment but receive the payment in October. Your accountant will record revenue of $1,500 in September. However, the money will actually get collected in October (reflected in your CFS statement of October).

A statement of cash flow provides a summary of 3 types of cash flow movements during a specific period.

Cash flows from operation activities: This represents the amount of cash generated by your restaurant business in a specific period. So, you will include here all cash inflows that you amassed from your customer orders, as well as cash outflows, which include the money you paid for food items and other things, like raw materials and consumables.

Cash flows from investing activities: In this section, cash inflows denote the money you collected from selling a Capex item (like an old furniture or kitchen appliance) or an asset. Cash outflows, on the other hand, refer to money needed for acquiring new assets (like new kitchen equipment or a new delivery bike).

Cash flows from financing activities: In this section, cash inflows refer to new capital raised from equity investors or a business loan, while cash outflows refer to money paid to partners, like dividends.

Investors like businesses with a solid ability to generate substantial cash flows on a consistent bases. Having a profitable restaurant alone isn’t enough; what’s of the most importance is whether the restaurant business has the ability to generate sizeable cash flows on a consistent basis.

By using our automatic Restaurant Financial plan in Excel included in our ready-made Restaurant Business Plan package, you can generate a comprehensive cash flow statement with just a few clicks. All you have to do is update the cost and revenue assumptions for a given period and you’re all set.

Restaurant Financial Plan: Balance Sheet

This financial statement gives a summary of the assets and liabilities of your restaurant business over a specific period. Here’s the formula summarizing a balance sheet:

Assets = Liabilities + Equity

By using our Restaurant Financial plan in Excel that’s included in the premium Restaurant Business Plan package, you can easily generate a balance sheet automatically by entering the cost and revenue assumptions in the model.

Restaurant Financial Plan: Conclusion

Thanks to this comprehensive guide, by now you have a clear idea about how to create a solid restaurant financial plan. Keep in mind that a comprehensive financial plan, one that includes proper cost and revenue models, is a must-have for every serious restaurant business. Of course, you can create this all by yourself, but it will take you a lot of time and effort. If you would rather focus on the restaurant project itself and save time and effort by simplifying the process, then consider using our automatic Excel financial plan, which is a part of our Restaurant Business Plan Template.