When it comes to launching an online store, a well-crafted E-commerce financial plan is an essential component of your business planning process. It serves as a roadmap that outlines your project’s financial goals, strategies, and projections for the future. It provides clarity and helps you make informed decisions about your E-commerce venture’s operations, growth, and profitability.

As a seasoned business planner with over 15 years of experience helping e-commerce entrepreneurs, my goal is to walk you through the process of creating a detailed financial plan specifically tailored to the online shopping business. We will cover key aspects such as cost forecasting, revenue projections, income statement forecasts, cash flow management, balance sheet forecasting, capital expenditures, startup costs, and capital raising strategies.

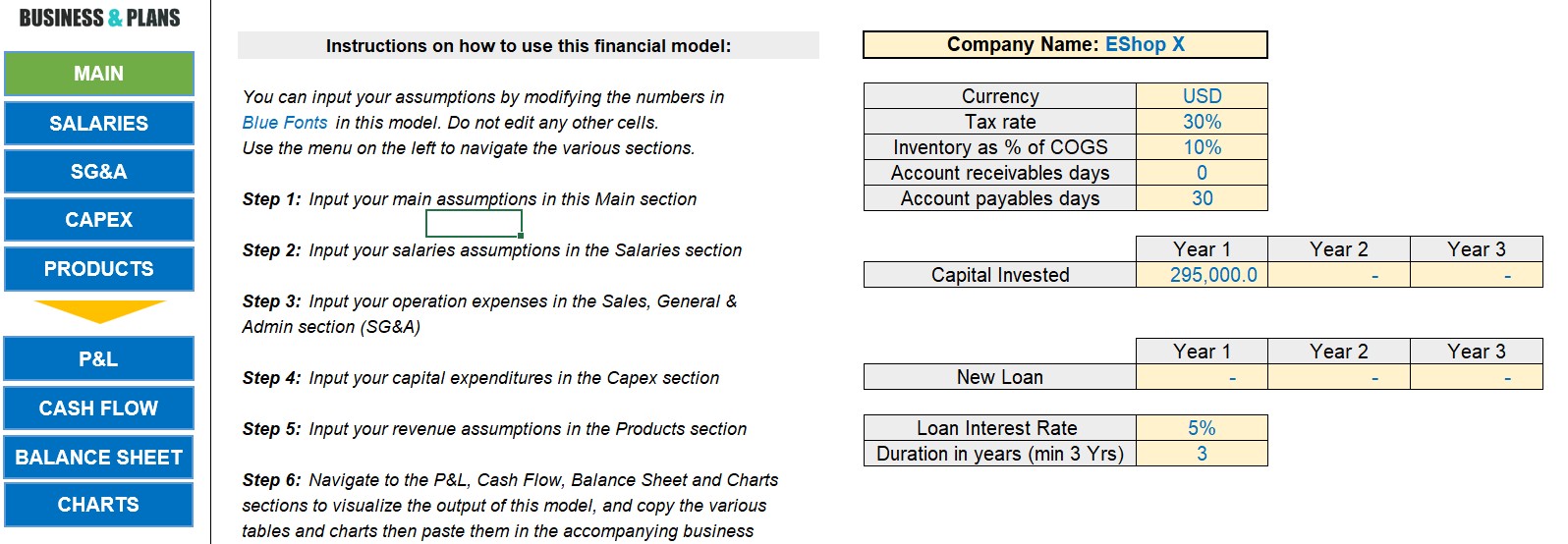

E-Commerce Financial Plan Template in Excel

Before diving into the specifics of each section, it’s important to emphasize the importance of accuracy and realism in your financial projections. While forecasting can be challenging, it is crucial to base your estimates on thorough research, industry benchmarks, and realistic assumptions. To help you build a strong financial forecast using a spreadsheet, we invite you to check out our ready-made e-commerce business plan package. It includes a pre-written business plan text in Word and an automatic e-commerce financial plan in Excel that you can easily customize, no accounting or financial expertise needed.

Now, let’s proceed to the first section of our guide: the cost forecast.

E-Commerce Cost Forecast

A cost forecast is a critical element of your financial plan as it helps you estimate and allocate expenses related to running your E-commerce business. By accurately forecasting your costs, you can plan your budget effectively, identify areas of potential savings, and ensure that your online shopping business remains financially sustainable. Let’s explore the key components to consider when creating a robust cost forecast:

Cost of Goods Sold (COGS)

The Cost of Goods Sold represents the direct costs associated with producing or acquiring the products you sell online. This includes the cost of raw materials, manufacturing or procurement costs, packaging, and any other expenses directly tied to the production process. Calculate your COGS by determining the unit cost of each product and multiplying it by the projected sales volume.

Operating Expenses

Operating expenses encompass the day-to-day costs of running your online shop. They can include:

- Marketing and Advertising: Budget for digital marketing campaigns, social media advertising, paid search, search engine optimization (SEO), influencer collaborations, and other promotional activities. Marketing is a major component of the total expenses required to run an e-commerce site. Make sure to include media spend and agency fees if you decide to outsource your campaigns management.

- Website and Hosting: Include costs related to website development, maintenance, hosting fees, domain registration, and security measures.

- Inventory Management: Don’t forget to account for expenses associated with inventory tracking software, warehouse storage, order fulfillment, and logistics. A successful e-commerce business has a strong inventory management practice.

- Customer Service: This includes customer support tools, live chat services (human based or AI-powered), returns management, and order inquiries.

- Payment Processing: Factor in fees associated with payment gateways, credit card processing, and fraud protection.

- Utilities and Office Supplies: This includes costs of utilities, office rent, internet, telephone services, and office supplies.

- Professional Services: Account for expenses related to legal, accounting and consulting services.

- Employee Salaries: If you have employees, include their salaries, benefits and payroll taxes.

- Software and Subscriptions: Include fees for essential software tools, such as inventory management systems, accounting software, and customer relationship management (CRM) platforms.

- Miscellaneous Expenses: It is always a good idea to allow for unexpected or miscellaneous expenses that may arise during the operation of your online store.

Next, we will delve into capital expenditures, where we will discuss investments in long-term assets and infrastructure.

Capital Expenditures

Capital expenditures (CapEx) refer to the investments made in long-term assets and infrastructure that are essential for your E-commerce business’s operations and growth. These expenditures typically involve large, one-time costs but provide benefits over an extended period. It is crucial to carefully plan and forecast your capital expenditures to ensure efficient allocation of resources. Let’s explore the key considerations for this section:

Technology and Equipment

An e-commerce website could be classified as both CAPEX and OPEX, depending on the nature of the expenses incurred. The initial development and setup costs of the website, including design, coding, and customization, would typically be considered capital expenditures (CAPEX) since they involve the acquisition or improvement of a long-term asset.

However, ongoing expenses such as hosting fees, domain registration, maintenance, and updates would be considered operational expenditures (OPEX) since they are recurring costs necessary to keep the website operational.

Here are additional items you may consider as Capex:

- Hardware: Estimate costs for computers, servers, networking equipment, and other devices required for your E-commerce operations.

- Software: Include costs for specialized software applications, such as inventory management systems, order management systems, customer relationship management (CRM) tools, and analytics software.

- Security Systems: Account for investments in cybersecurity measures, SSL certificates, fraud detection, and prevention tools.

- Communication Systems: Budget for phone systems, video conferencing software, and other communication tools necessary for your business’s smooth operation.

Physical Infrastructure

Let’s now look at potential investments in your physical infrastructure:

- Warehousing and Storage: Include costs for acquiring or leasing warehouse space, racking systems, shelving, forklifts, and other equipment needed for inventory storage.

- Packaging and Shipping Equipment: Account for investment related to equipment that help with packaging, scaling, labeling and shipping software.

- Vehicles and Transportation: In case you will handle the delivery in-house, make sure to include the cost of trucks, cars or bikes you plan to purchase.

- Fulfillment Centers: If you’re considering establishing additional fulfillment centers or partnering with third-party logistics providers, include the associated investment.

- Technology Upgrades: Budget for system upgrades or enhancements to handle higher order volumes and improve efficiency.

Depreciation and Replacement

Keep in mind that certain capital assets have a limited lifespan and will require periodic replacement or upgrade. This is why it is a good idea to estimate the depreciation of your assets over time and allocate funds for their eventual replacement.

By carefully considering and forecasting your capital expenditures, you can ensure that you have the necessary resources to support the growth and development of your E-commerce business.

E-Commerce Startup Costs

When starting an E-commerce business, there are several initial expenses you need to consider. These startup costs encompass the one-time investments required to establish your business and set it up for operation. Properly estimating and planning for these costs is essential for a smooth launch. Let’s explore the key components to consider when creating a startup cost forecast:

- Market Research and Validation: Before launching your E-commerce business, you need to conduct market research to understand your target audience, competition, and demand for your products or services. Include expenses related to market research reports, surveys, focus groups, and prototype testing.

- Business Registration and Licensing: This includes the costs associated with registering your business entity and obtaining the necessary licenses and permits such as registration fees, legal consultation fees, and any government or regulatory charges.

- Initial Website Development and Design: Invest in professional website development and design to create an appealing and user-friendly online store. Include initial expenses for domain registration, website hosting, e-commerce platform subscriptions, and hiring web developers or designers if needed.

- Branding: A powerful brand can go a long way in helping you launch and scale a successful e-commerce business. Make sure you budget funds for branding activities to establish a strong brand identity. This may include logo design, brand guidelines, graphic design services, and marketing materials.

- Inventory and Product Sourcing: Estimate the initial investment required to acquire or manufacture your initial inventory. This includes purchasing products, raw materials, packaging materials, and any costs associated with product sourcing, manufacturing or distribution.

- Equipment and Tools: As already seen above, the initial capex required for essential equipment and tools should also be part of your startup investment.

- Professional Services: In case you plan to avail any professional services to help you with the launching phase, then you need to also account for things such as legal consultation, accounting services, or consulting fees for strategic advice…etc.

- Initial Marketing and Advertising: Some entrepreneurs allocate a budget for initial marketing and advertising efforts to generate awareness and drive traffic to their E-commerce website. This could be your soft launch, before the full-fledged store launch.

- Training and Education: If necessary, budget for any training programs or courses that will enhance your skills or knowledge relevant to running an E-commerce business. This could include online courses, workshops, or conferences.

Now that we have seen the main cost items related to starting and running and e-commerce business, let us tackle the revenue forecasting process, as part of your e-commerce financial plan.

E-Commerce Revenue Forecast

Accurately forecasting your online store’s revenue allows you to set realistic goals, make informed business decisions and monitor your operational performance. Before we start, it is key to remember the importance of a solid market analysis to understand your target audience, market trends, competitive landscape, and demand for your products or services. This analysis will provide valuable insights that will inform your revenue projections.

Sales Channels

First, identify the sales channels through which you will generate revenue. For your online store, this typically includes your own e-commerce website, marketplace platforms (such as Amazon or eBay), and any other channels where you plan to sell your products.

Pricing Strategy

Determine the right pricing strategy for your products or services. Consider factors such as production costs, competitor pricing, customer willingness to pay and perceived value. Your pricing strategy should strike a balance between profitability and competitiveness in the market.

Online Sales Volume Forecast

Estimate the number of products or services you expect to sell during the forecast period. This can be based on historical data, market research/sizing, industry benchmarks, or a combination of these factors. Consider variables such as seasonality, trends, and any marketing or promotional activities that may impact your sales volume.

Average Order Value (AOV)

What is AOV? This stands for Average Order Value, a key metric to monitor when running your e-commerce site. You can calculate AOV by dividing the total revenue by the total number of orders during a given period. It is always a good idea to compare your AOV against industry benchmarks.

Customer Acquisition

How will you acquire new customers? What are the associated costs? Account for marketing and advertising expenses, customer acquisition strategies, and conversion rates when estimating the number of new customers you expect to acquire during the forecast period.

Repeat Business and Customer Retention

When modeling your revenue, remember to factor in customer retention rates and the likelihood of repeat purchases. Analyze historical data or industry benchmarks to estimate the percentage of customers who are likely to make repeat purchases and the frequency of those purchases.

Seasonality and Trends

All businesses are exposed to a certain level of seasonality and e-commerce platforms are no exception. Take into account any seasonal fluctuations or trends that may impact your online store by adjusting your revenue forecast accordingly, considering peak seasons, holidays, or other events that may affect customer buying behavior.

New Product Launches or Expansion

If you plan to introduce new products or expand your product line during the forecast period, include the projected revenue from those additions. Consider market demand, production costs, and marketing efforts when estimating the revenue contribution from new products.

E-Commerce Key Performance Indicators (KPIs)

Now let’s look at a number of important key performance indicators any e-commerce entrepreneur should monitor closely to ensure the success of their online shopping ventures. Here we go:

Customer Acquisition Cost (CAC)

Customer Acquisition Cost refers to the amount of money your E-commerce business spends to acquire a new customer. It includes the marketing and advertising expenses incurred to attract potential customers and convert them into paying customers. Calculating your CAC helps you assess the effectiveness of your marketing efforts and determine the financial viability of acquiring new customers.

To calculate your CAC, divide the total marketing and advertising expenses by the number of new customers acquired within a specific period. For example, if you spent $10,000 on marketing and acquired 100 new customers, your CAC would be $100.

Customer Lifetime Value (CLV)

Customer Lifetime Value represents the total net revenue your online store expects to generate from a single customer over the course of their relationship with your business. It takes into account the repeat purchases, average order value and customer retention rates. The CLV is important because it provides insights regarding the actual longer term value of your customers.

Here’s how to calculate CLV:

CLV = AOV x Purchase Frequency x Customer Lifespan

For example, if your average purchase value is $50, the average purchase frequency is 2 times per year per customer, and the average customer lifespan is 3 years, your CLV would be $300 ($50 x 2 x 3).

CLV to CAC Ratio

The CLV-to-CAC Ratio is a key metric that compares the cost of acquiring a customer (CAC) to the expected revenue generated from that customer over their lifetime (CLV). This ratio helps you assess the sustainability and profitability of your customer acquisition efforts.

Ideally, the CAC should be significantly lower than the CLV to ensure a positive return on investment. A lower CLV-to-CAC ratio indicates that your customer acquisition costs are too high compared to the revenue you expect to generate from each customer.

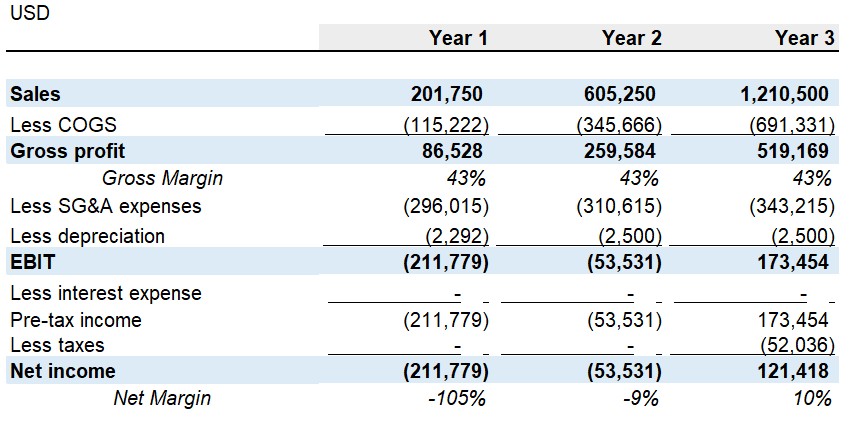

E-Commerce Income Statement Forecast

The income statement forecast, also known as the P&L (profit and loss statement), is a major financial statement that provides an overview of your E-commerce business’s revenue, expenses, and net income over a specific period of time. It helps you understand the profitability of your business and identify areas where you can optimize costs or increase revenue. Let’s explore the key components of your online store’s P&L:

Revenue (Top Line)

Start by including your projected revenue for the forecast period, which we discussed in the previous section. This includes the total sales generated from your E-commerce business, considering factors such as sales volume, average order value and customer retention.

Cost of Goods Sold (COGS)

Calculate the cost of goods sold by estimating the direct costs associated with producing or acquiring the products you sell. Subtract the COGS from the revenue to determine the gross profit.

Gross Profit Margin

Calculate the gross profit margin by dividing the gross profit by the revenue and multiplying by 100. The gross profit margin indicates the percentage of revenue that remains after deducting the direct costs of producing goods or services. It helps assess the efficiency of your production/sourcing and pricing strategies.

Operating Expenses

Next, list all the operating expenses we discussed earlier in this guide, such as marketing and advertising, website and hosting costs, inventory management, customer service, payment processing, utilities and office supplies, professional services, employee salaries, software and subscriptions, and miscellaneous expenses.

Operating Income

Now, subtract the total operating expenses from the gross profit to calculate your e-commerce store’s operating income. The operating income represents the profit generated from your core business operations before considering interest, taxes, and other non-operational items.

Non-Operating Income and Expenses

If applicable, include any non-operating income or expenses that are not directly related to your E-commerce business’s day-to-day operations. This may include interest income, interest expenses, investment gains or losses, and any other income or expenses outside of your primary business operations.

Net Income (Bottom Line)

Subtract the non-operating income and expenses from the operating income to calculate the net income. The net income represents the final profit or loss generated by your E-commerce business after considering all income and expenses.

Profit Margin

You can also calculate the profit margin by dividing the net income by the revenue and multiplying by 100. The profit margin provides an overall view of your business’s profitability and indicates the percentage of revenue that translates into actual net income.

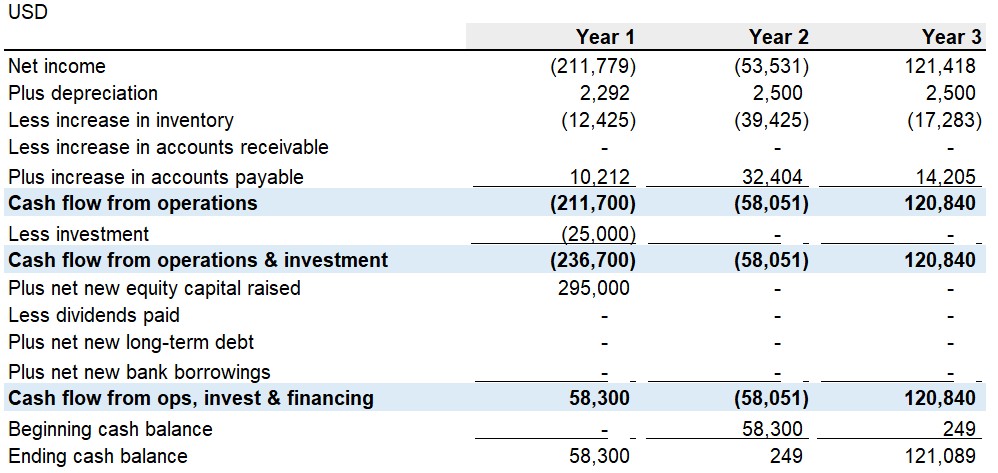

E-Commerce Cash Flow Forecast

A cash flow forecast is a vital component of your financial plan as it helps you project the inflows and outflows of cash in your online shopping business over a specific period. It allows you to anticipate cash shortages or surpluses, plan for capital expenditures, and ensure you have sufficient funds to meet your financial obligations. Let’s explore the key considerations for this section:

Cash Inflows

First, identify and project the various sources of cash inflows for your E-commerce business:

- Sales Revenue: Estimate the cash inflows from your E-commerce sales based on your revenue forecast. Consider the payment methods your customers use, such as credit cards, online payment platforms, or cash on delivery, and the typical payment terms or delays associated with each method.

- Financing Activities: Include any cash inflows from external financing sources, such as loans, investments, or capital contributions. Take into account any anticipated cash injections into your business during the forecast period.

- Other Income: If applicable, consider any other sources of cash inflows, such as interest income, rental income or affiliate program earnings.

Cash Outflows

Next, identify and project the various categories of cash outflows:

- Cost of Goods Sold (COGS): Estimate the cash outflows associated with purchasing or producing your products. Consider the payment terms with your suppliers, inventory management practices, and any upfront or periodic payments required for inventory.

- Operating Expenses: Include the cash outflows related to your operating expenses (see sections above). Here as well, pay attention to the payment terms.

- Taxes and Regulatory Payments: Account for the cash outflows associated with taxes, licensing fees, permits, and any other regulatory obligations specific to your E-commerce business.

- Debt Payments: If you have outstanding loans or debts, estimate the cash outflows required for repayment. Consider the repayment terms, interest rates, and any scheduled principal and interest payments.

- Capital Expenditures: Refer to the capital expenditures section we discussed earlier. Estimate the cash outflows required for investments in technology, infrastructure, equipment, vehicles and other long-term assets.

- Other Expenses: Consider any other cash outflows that are not categorized above but are relevant to your E-commerce business, such as one-time project expenses, legal fees, or unexpected costs.

Net Cash Flow

Calculate the net cash flow for each period by subtracting the total cash outflows from the total cash inflows. A positive net cash flow indicates a surplus, while a negative net cash flow indicates a deficit.

Cash Flow Statement

Use the projected cash inflows and outflows to create a cash flow statement, which provides a comprehensive view of your E-commerce business’s cash position. The cash flow statement includes three sections: operating activities, investing activities, and financing activities. It helps you track the cash flows from your day-to-day operations, investments, and financing transactions.

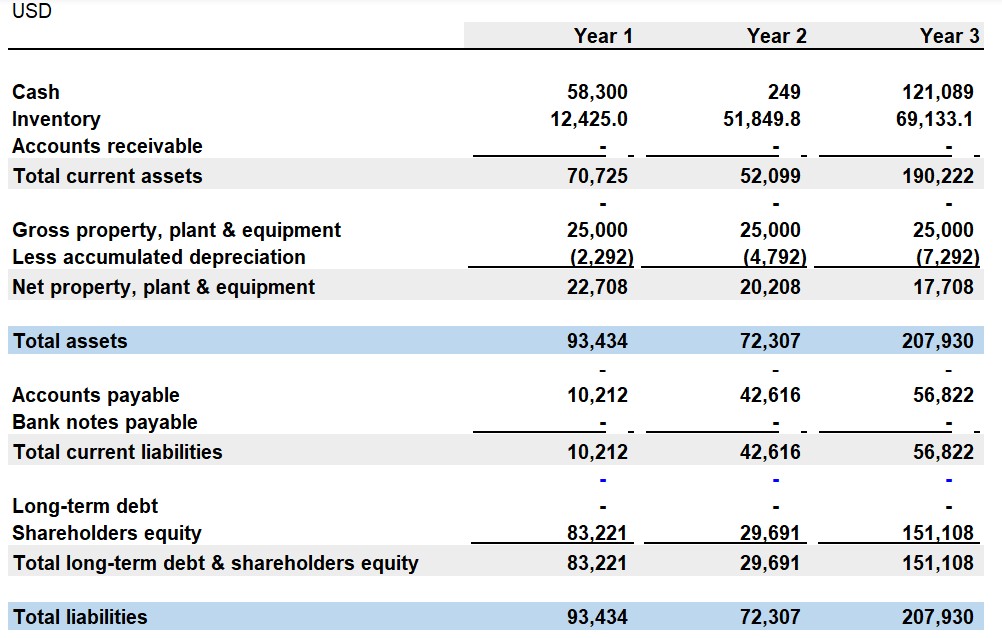

E-Commerce Balance Sheet Forecast

The balance sheet forecast is a financial statement that provides a snapshot of your E-commerce business’s financial position at a specific point in time. It summarizes your assets, liabilities, and owner’s equity, allowing you to assess your business’s solvency and net worth. Let’s explore the key considerations for this section:

Assets

The first part of the balance sheet lists the short-term and long-term assets of your E-commerce business:

- Current Assets: These are assets that can be converted into cash within one year. This includes cash and cash equivalents, accounts receivable, inventory and any other short-term assets.

- Fixed Assets: Estimate the value of your fixed assets, which are long-term assets with a useful life beyond one year. This includes property, plant, and equipment, such as your office space, computers, servers, and any other tangible assets used in your E-commerce operations.

- Intangible Assets: If applicable, consider also any intangible assets your E-commerce business may have, such as intellectual property rights, patents, trademarks, or goodwill.

Liabilities

The second part of the balance sheet comprises short and long term liabilities for your E-commerce business:

- Current Liabilities: Estimate the value of your current liabilities, which are obligations that are due within one year. This includes accounts payable, short-term loans, credit card debt, accrued expenses, and any other short-term obligations.

- Long-Term Liabilities: These include obligations that extend beyond one year such as long-term loans, lease obligations and any other long-term debts.

Shareholder’s Equity

This section goes next to liabilities. Calculate the shareholder’s (or owner’s) equity, which represents the net worth of your E-commerce business. It is the residual interest in the assets of your business after deducting liabilities. Owner’s equity includes the initial capital investment, retained earnings, and any additional contributions or withdrawals made by the owner(s).

Balance Sheet Structure

Organize the projected assets, liabilities, and owner’s equity in a balance sheet format following the equation: Assets = Liabilities + Shareholder’s Equity.

Financial Ratios

It is a good idea to regularly analyze your balance sheet forecast and calculate key financial ratios that provide insights into your E-commerce business’ financial health. Some important ratios to consider include the current ratio (current assets divided by current liabilities), debt-to-equity ratio (total debt divided by owner’s equity) and return on equity (net income divided by owner’s equity). These ratios help assess liquidity, leverage, and profitability.

Final Words

Writing a comprehensive financial plan is crucial for the success and sustainability of your online shopping venture. It provides a roadmap for achieving your financial goals, helps you make informed decisions, and ensures the financial health of your business.

Before we part, we highly recommend you check our automatic e-commerce financial plan Excel template included in our ready-made e-commerce business plan package. Our cost-effective solution allows you to build a solid business plan with accurate financials in record time.

Best of luck in creating a robust financial plan for your E-commerce business, and may it pave the way for your success and prosperity!