If you wish to start a Bakery or if you are building a business plan, you need a powerful bakery financial plan that helps you gauge the new opportunity from an economic and financial standpoint.

Additionally, if you are seeking an investor or trying to convince a friend or business partner to be part of your project, then a bakery financial plan is required to help you persuade other potential stakeholders and successfully raise capital.

Although building a strong and convincing bakery financial plan is no simple task, the very purpose of this article is to shed light on important aspects with the aim to simplify the process and help you understand key financial concepts. Our main purpose is to help you build a complete and detailed bakery financial plan which you can use to raise funding, whether from an equity partner or from a bank (in the form of a loan).

Bakery Financial Plan Excel Template

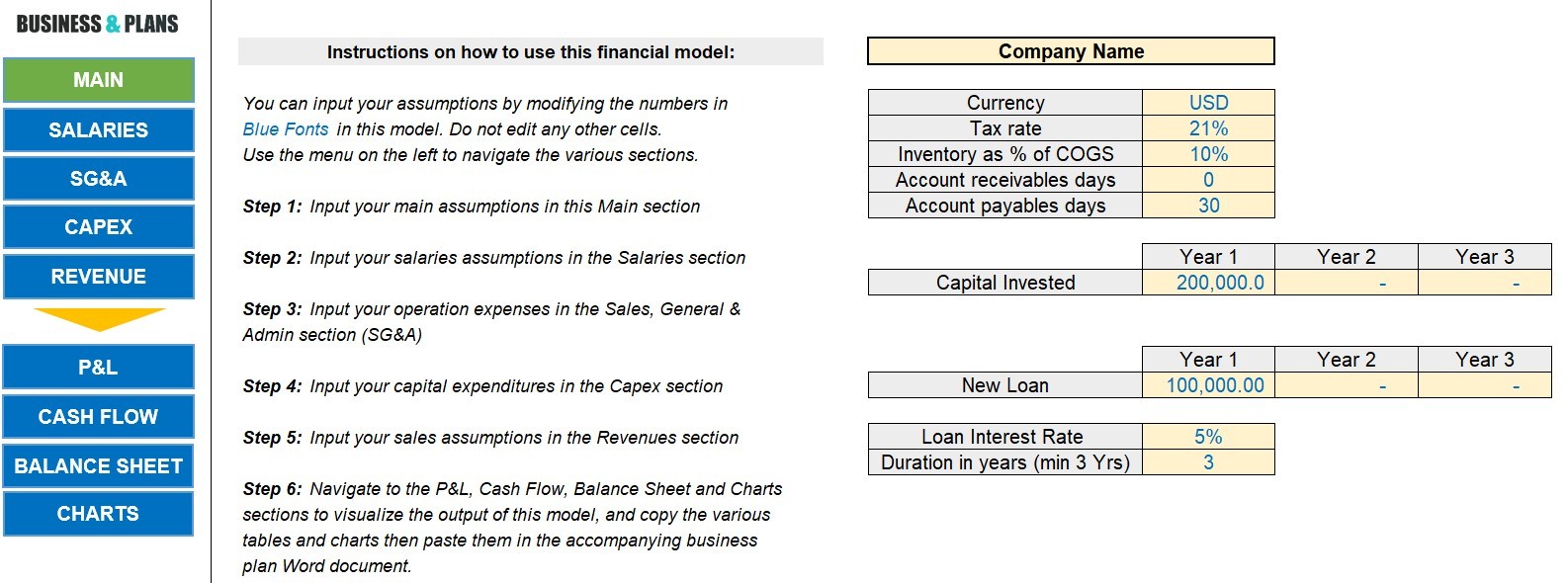

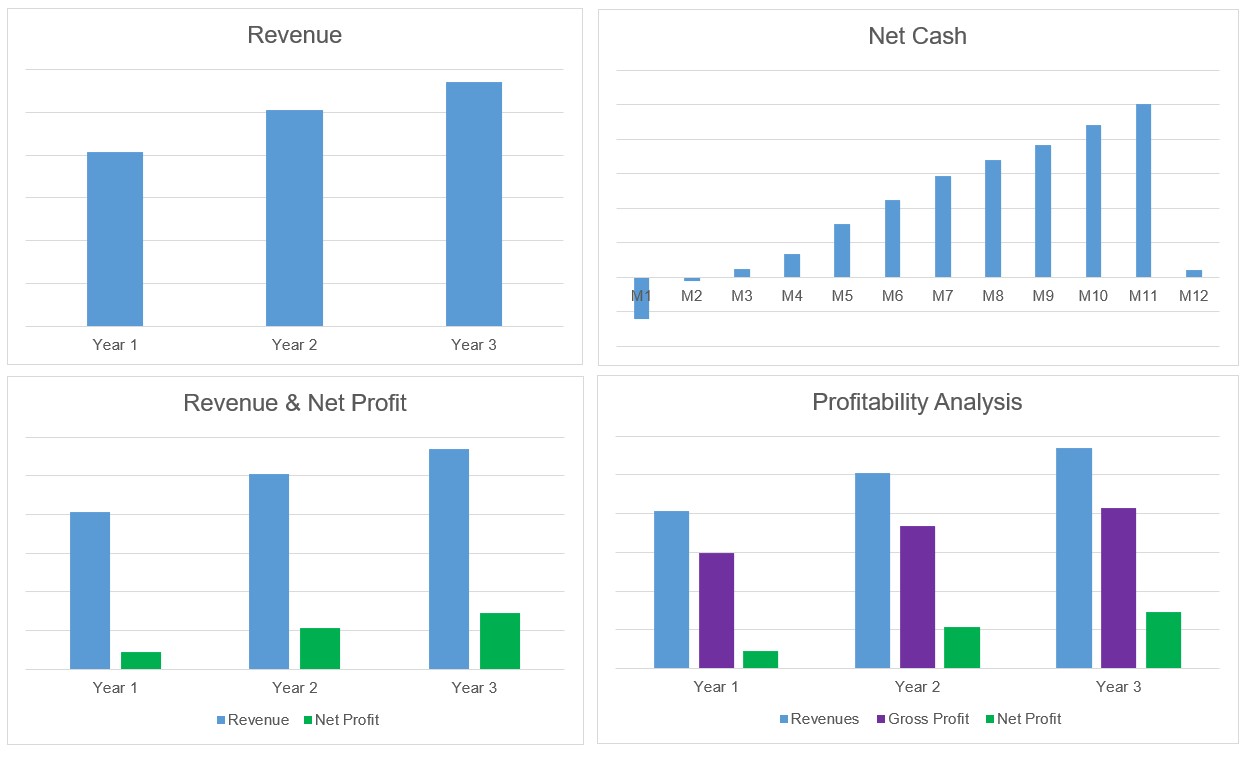

Before we dive in our detailed guide that explains what to include in your bakery financial plan, you might be interested to check our ready-made Bakery Business Plan Template that includes an automatic and fully customizable pro-forma financial model in Excel tailored to the Bakery business. Below are a couple of screenshots to give you an idea.

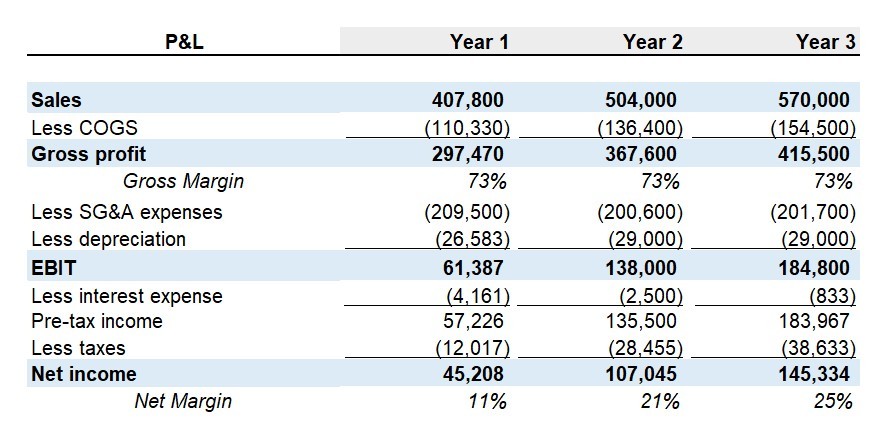

You don’t need any advanced accounting or financial knowledge to use or understand the Excel financial plan, all you have to do is adjust a number of cost and revenue assumptions to fit your own Bakery project and the model will automatically generate key financial statements including Profit & Loss statement, Cash Flow statement and Balance Sheet, in addition to a number of important charts and tables that you can later paste in your bakery business plan.

Now let’s get started. What are the main components of a strong bakery financial plan? The following sections will tell us.

Bakery Financial Plan: Costs Forecast

First, you need to understand the various costs and expenses involved in a bakery business.

There are two main categories of costs: Costs Of Goods Sold (COGS or Direct Costs), and Operating Expenses (Opex) and the latter include Sales, General and Administrative expenses.

Let’s tackle first the direct costs linked to the bakery business. These costs include the cost of purchasing raw materials to prepare your bakery products, such as: flour, seeds, salt, milk…etc. They also include anything you pay third-party external suppliers for goods you don’t prepare yourself and that you resell to your customers such as: beverages, coffee, napkins…etc.

Regarding the operating expenses involved in running a Bakery business, these costs usually include the salaries you pay your staff, your marketing and advertising expenses, your rent, utilities, phone, internet, licensing costs…etc. These expenses are crucial to help you run and promote your Bakery and hence we call them operating expenses.

By adding your COGS and Operating Expenses, you can then forecast the total costs involved in running a Bakery business.

Don’t forget that some expenses increase over time. For instance, salaries increase over time because you usually give existing employees a raise and may also hire additional staff as your bakery grows. Other costs tend to be stable such as your bakery’s rent, utilities, insurance…etc.

Make sure you take into consideration these cost changes as you develop your bakery’s financial plan.

Bakery Financial Plan: Capital Expenditures

The second step entails understanding the capital expenditures that come with launching a Bakery business, but before we move forward, let us define what are capital expenditures and see how they differ from other costs. A simple definition of a capital expenditure (or Capex) is any investment you make to purchase a valuable equipment or long-term asset such as a breadmaking oven, furniture for the bakery or a POS system.

Capex includes long-term assets that are used for many years to come. Therefore, accountants usually depreciate them for the duration of the project rather than simply expensing them as mere operating costs.

With regards to your Bakery project, examples of capital expenditures (or Capex) include breadmaking equipment, furniture and decoration, IT and security system, van or truck for deliveries…etc.

Bakery Financial Plan: Startup Costs

Your startup costs are the pre-operating expenses and investments you need to make before your bakery starts generating revenue. For example, getting a license for operating as an independent bakery is one of these costs incurred prior to launching operations along with other potential expenditures listed below:

- Initial equipment and long-term assets needed to launch the bakery such as fitting out and decorating the shop, buying kitchen appliances, a POS system…etc.

- Conducting research and building a business plan for the bakery project

- Paying the rent deposit to secure the location

- Paying a graphic designer for creating a logo and your bakery’s brand identity

Bakery Financial Plan: Revenue Forecast

After modeling your costs, it’s time to forecast how much revenue your bakery will generate. Here, there are many assumptions that need to be made like the number of customers you receive during a certain period of time and what they spend on average per order. But making educated assumptions based on market surveys or industry reports can help you reduce your margin of error drastically.

For instance, to estimate your number of daily customers, you can look at the number of people in a certain age group, living in your neighborhood, and start making assumptions based on this info. An example is probably the best way to see the full picture:

Suppose there are 5,000 people between the age of 20 and 40 living nearby your bakery, and let’s assume that only 5% of them will visit your bakery at least once a month (some will visit more frequently than others); this means that you have around 250 frequent monthly customers. Let us also assume that each client visits the bakery three times a month with an average order value of 15 USD, this results in a monthly revenue of 11,250 USD (250 x 3 x 15).

Your annual revenue forecast is simply 11,250 x 12 = 135,000 USD approximately. In reality, you should also take into consideration the impact of seasonality, in other words, your revenue might be higher or lower during certain months or seasons of the year (for example, your monthly revenue in the fall season might go up compared to the summer because people come back from holidays and kids return to schools…etc.)

In all cases, it is paramount to use conservative assumptions backed by reliable research or sources when modeling your revenue.

Bakery Financial Plan: Income Statement or Profit & Loss

The income statement, also called profit or loss statement or P&L, is a key financial statement that summarizes the operations of your bakery over a certain period of time.

It is based on a simple formula that takes your bakery’s revenue and subtracts from it your direct costs or COGS, your operating expenses, your depreciation (applied on your long-term assets), your interest expenses and your taxes to finally calculate your net profit (or loss).

The income statement is important because it shows if your bakery is profitable or not, and provides investors with valuable financial information to assess your project.

The P&L statement is usually modeled in Excel and presented in a table format that you paste in your bakery business plan.

By using our Bakery Financial model included with our premium business plan template, you don’t need to worry about building an income statement from scratch. This financial statement is automatically generated once you edit your cost and revenue assumptions, hassle-free.

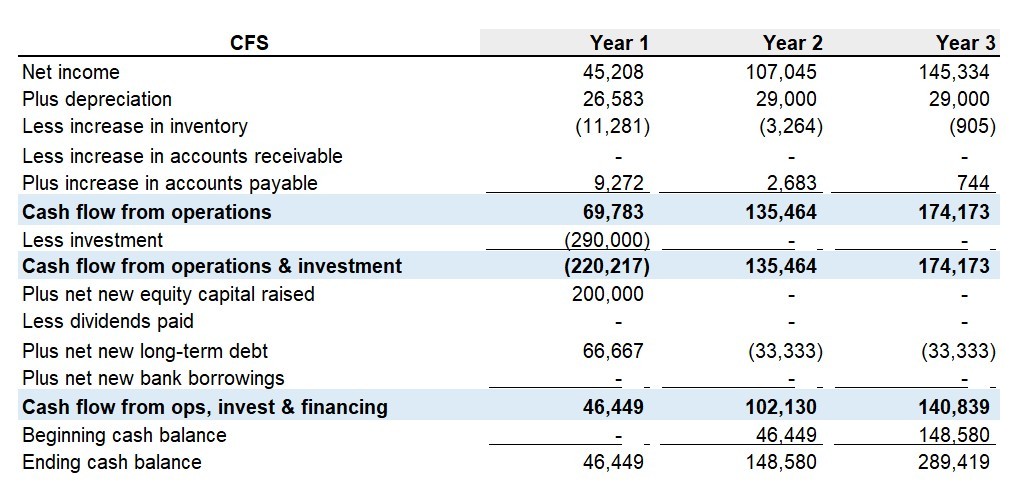

Bakery Financial Plan: Cash Flow Statement

The second key financial statement for your bakery business is called the cash flow statement, or statement of cash flows.

Let’s first discuss a few important concepts to better understand how this financial statement works and why it’s important.

Did you know that cash and revenue are two distinct things? And did you know that expense and cash are two different concepts? Here’s how: Suppose you receive an invoice for 1,000 USD from a flour supplier dated October 10 and that you have 30 days to pay it. On November 20, you pay the amount via bank transfer. What happens in your financial statements is the following: In October, your P&L recorded an expense of 1,000 USD but nothing is recorded in the Cash Flow Statement, while in November, your Cash Flow Statement recorded a cash outflow of 1,000 USD and nothing is recorded in the P&L.

Moreover, some items that are considered as expenses in the P&L are non-cash items and thus not recorded in the Cash Flow Statement. Take for example depreciation. When you depreciate your breadmaking over, you record in the income statement a monthly amount that takes away from your profits while in the cash flow statement, there is no such thing. You only record the initial amount of money you paid for to acquire the breadmaking oven at the time of purchase.

So, coming back to the cash flow statement, it is a summary of the cash movements occurring in your bakery business over a certain period of time. These cash movements are categorized into 3 main groups: Cash flows from operating activities, cash flows from investing activities and cash flows from financing activities.

Remember that investors care a lot about the cash situation in your bakery project and a cash generating business is a very attractive investment.

If you use our Bakery Financial plan in Excel included in our premium Bakery Business Plan package, you will be able to automatically generate a detailed cash flow statement after updating your cost and revenue assumptions.

Bakery Financial Plan: Balance Sheet

The balance sheet is another major financial statement that can be summarized using the following formula:

Assets = Liabilities + Equity

It is simply a picture of your business at a certain point in time (usually monthly, quarterly or yearly). The balance sheet shows readers what your bakery owns and what it owes, while the difference is its net worth.

Assets usually comprise your short-term (e.g. cash and equivalent, receivables) and long-term assets (e.g. property, equipment) while liability includes short-term liabilities (e.g. accounts payable) and long-term ones (e.g.: bank loan). Equity is basically the capital contributed by the business partners.

By using our Excel Bakery Financial plan included in our pre-written Bakery Business Plan package, you will be able to automatically generate a detailed balance sheet after updating your main cost and revenue assumptions.

The Benefits of Creating a Financial Plan for your Bakery

Before we wrap up, we wish to stress again the importance of building a proper financial plan for your bakery project. In fact, the many benefits of a solid bakery financial model include but are not limited to:

Establishing financial goals: A robust financial plan helps to establish specific, measurable financial goals for your bakery, such as increasing revenue or reducing expenses.

Identifying funding needs: It can help you identify the funding needs of the business, including start-up costs, working capital, and long-term investment.

Allocating resources: A properly laid out financial model can help you allocate resources, such as capital and personnel, to the most important areas of the bakery business.

Monitoring performance: You can also use it to monitor the performance of the bakery over time and to make adjustments as needed to achieve your financial goals.

Attracting investors: This one is a no-brainer. A well-crafted financial plan is crucial to attract investors and secure funding for your bakery venture.

Improving decision making: Finally, a detailed bakery financial forecast can help you make better-informed decisions about the future of the business by providing you with a clear picture of the financial position and future projections.

Bakery Financial Plan: Conclusion

We hope you enjoyed our detailed bakery financial plan guide and that it will help you build a solid financial forecast for your bakery project. In case you wish to save time and money, we highly recommend you download our automatic bakery financial plan template in Excel included in our ready-made bakery business plan package. It allows to create a robust financial forecast for your bakery fast and easy and no financial expertise is required on your part. You also receive a full and pre-written business plan tailored to the bakery business.