Are you looking to launch a beauty salon? Have you tried to create a beauty salon financial plan? Or maybe are you in the process of building a business plan for your beauty salon but are a bit lost when it comes to forecasting your costs, revenues and profits?

Launching a beauty salon requires you to properly understand and estimate your project’s costs, revenue and other financial information. In this post, we will go through all the nuts and bolts of developing a proper beauty salon financial plan to help you not only plan and successfully execute your beauty salon but also get ready to engage with serious investors.

Beauty Salon Financial Plan Excel Template

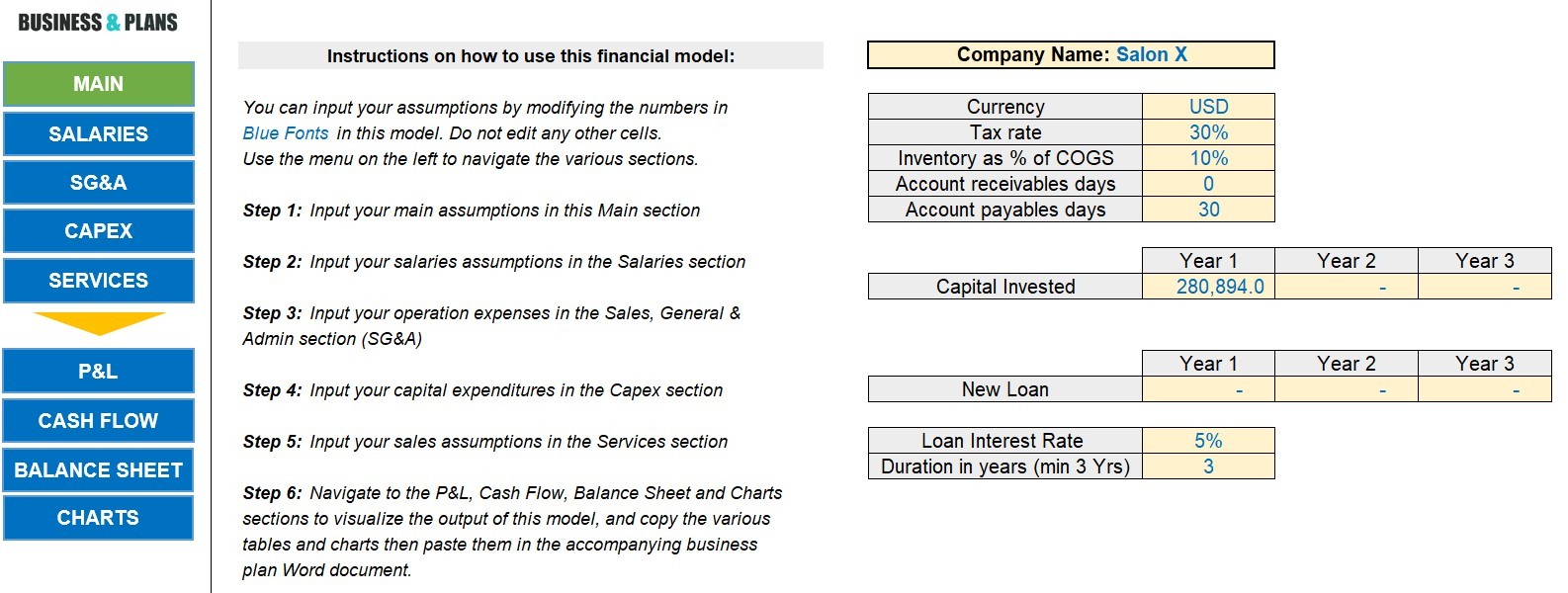

Before we start, we suggest you check out our automatic financial plan included in our ready-made beauty salon business plan pack. Yes, we have done all the hard work on your behalf already! Our ready-made beauty salon financial plan consists of a detailed financial model in Excel with a 3-years cost, revenue, income statement, cash flows and balance sheet forecast. This off the shelf solution will you tons of time and money so you can focus instead on launching your beauty salon. Below is a screenshot from our automatic beauty salon financial plan in Excel:

The Benefits of Creating a Financial Plan for your Beauty Parlor

Creating a financial plan for your beauty salon is an important step in the process of starting and running a successful business. It helps you:

- Establish financial goals: A financial plan helps you set clear financial goals for your business such as the expected revenue, profit margin, and the number of customers you aim to have in the first year, this will help you to measure your progress and know when to make adjustments.

- Make informed decisions: Having a financial plan in place allows you to make data-driven decisions about your business, based on your projected revenues, costs, and cash flow. This information can help you identify areas where you need to cut costs or invest more money.

- Secure funding: A detailed financial plan is often required when applying for loans or investors, as it shows that you have a clear understanding of the financial needs of your business and how you plan to meet them. This includes information such as the total start-up costs, projected revenues, and an explanation of how you will use the funds.

- Anticipate and manage risks: A financial plan can help you identify potential risks to your business such as market changes, unexpected competition, and economic downturns. By identifying these risks, you can develop strategies to mitigate them, such as diversifying your services or building a strong online presence.

- Measure your performance: A financial plan allows you to track your business’s financial performance over time and make adjustments as needed. This includes monitoring key financial metrics such as revenue, profit margins, and customer acquisition costs.

- Budget and forecast your revenue: A financial plan helps you to budget your revenue and expenses and forecast your revenue to see how your salon will perform over time. This will help you to make strategic decisions such as increasing prices, offering new services, or expanding to new locations.

- Focus on key metrics: A financial plan helps you to identify key metrics that are important for the success of your salon, such as customer retention rate, revenue growth, and profit margins. By focusing on these metrics, you can make informed decisions to improve the performance of your salon, such as investing in customer service training or marketing campaigns.

For now, let us see what are the main components of a complete and solid beauty salon financial plan.

Beauty Salon Financial Plan: Costs Forecast

Doing your beauty salon costing exercise is crucial to properly understand the various expenses linked to launching and operating your project. To simplify things, remember there are two main types of costs: Direct cost and Indirect costs. In the case of your beauty salon, direct costs are usually expenses directly linked to the service and possibly products you are offering. These include the cost of the beauty products you are using (cosmetics, shampoos, conditioners, nail polish…etc.) or selling (branded hair care products, gels…etc.).

Indirect costs will include your sales, general and administrative expenses such as your rent, staff salaries, utilities, advertising expenses…etc.

Beauty Salon Financial Plan: Capital Expenditures

But what about the purchase of an equipment such as an expensive hair dryer? Well, unlike a consumable such as a hair product or an operating expense such as paying the rent, a hair dryer is actually an asset you own. This is why, purchasing equipment, vehicles or even real estate (if you decide buying the shop rather than renting for instance) are not categorized as costs but rather as capital expenditures or CAPEX.

Capex items are usually depreciated over a certain number of years depending on the life of the asset. For example, an expensive hair dryer would be depreciated over five years while a company vehicle would be depreciated over ten years. The depreciation figure is reflected in your income statement.

Beauty Salon Financial Plan: Startup Costs

The startup costs linked to a beauty salon project typically include the expenses you incur prior to operate the business. For example, paying for your company license, creating your brand identity, decorating and equipping the salon and using the services of a hiring company to hire your staff are all examples of pre-operating costs. Startup costs are important to evaluate because they give you an indication of how much capital you need to have to launch your beauty salon.

Beauty Salon Financial Plan: Revenue Forecast

Next, let’s talk about your beauty salon’s revenue. While evaluating and computing your beauty salon’s costs is rather straightforward, modeling your revenue is a bit more complicated. This is due to the fact that there are many assumptions and parameters that impact your revenue forecast namely:

- The number of customers you serve in a given day, month or year

- Your service and product mix

- Your pricing

- The seasonality linked to your beauty salon business

- The capacity and utilization rate of your employees

- Your repeat customer rate…etc.

To cut the long story short, you need to pay attention to all the above parameters while modeling your revenue forecast and the best approach is usually by starting on the conservative side and growing from there as your beauty salon becomes more popular and you start receiving a lot of referrals and repeat customers.

Keep also an eye on your capacity and make sure your revenue forecast implies a workload and number of customers that you can actually serve with your current and future setup.

Beauty Salon Income Statement or Profit & Loss

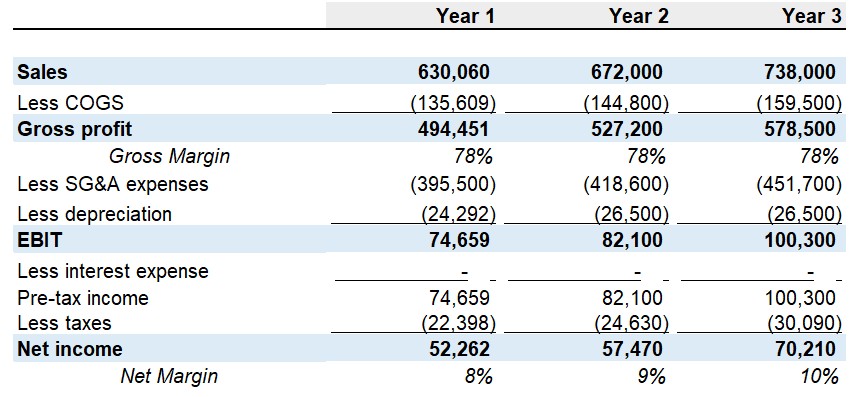

Once your cost and revenue forecasts are modeled, it is time to model your income statement, also called profit and loss statement, or simply, P&L.

The P&L is one of the most important financial statements when it comes to understanding your beauty salon from a financial perspective. Simply put, the income statement summarizes in a table the revenue, costs and profits generated by your beauty salon over a period of time. It is based on a simple formula that says:

Profits = Revenue – Costs

The top line represents your sales and then each subsequent line in the P&L table represents a type of expense.

The bottom line represents the net profit or loss. This is usually shared between the partners in the business in the form of dividends.

As shown in the example above, the P&L table also includes non-cash items such as the depreciation (which is typically not included in the cash flow statement, but more on that in the next section).

So, to gauge if a business is attractive or not, investors usually assess the amount of net income generated over a certain period of time. The higher the net income, the greater the value created by the business.

By the way, if you wish to save time and efforts, we highly recommend you check our off the shelf beauty salon business plan template that includes an automatic financial plan enabling you to generate a beauty salon income statement in a fast and convenient manner, no financial expertise required.

Beauty Salon Cash Flow Statement

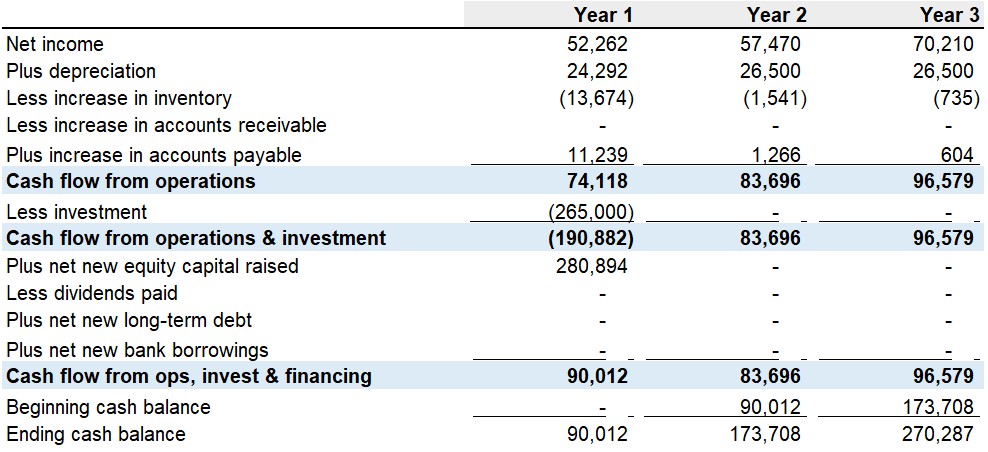

The statement of cash flows also called cash flow statement (or CFS) is another major financial statement you need to properly model if you are serious about planning your upcoming beauty salon venture.

One of the main differences between a cash flow statement and an income statement is the factor of time. To simplify things, you need to distinguish between an invoice and a payment. Invoices are recorded at the invoice date in the P&L which means when you send an invoice to a client, you usually record this as a revenue in your income statement whereas in the cash flow statement, you won’t record the revenue until you receive the actual payment which can happen much later in certain cases. The same applies for liabilities. Sometimes, you may pay a supplier invoice much later than the reception date. In that case, a cash outflow is recorded much later in your cash flow statement while you will record the liability at the invoice reception date in your income statement.

For the reasons above (among a few others), the cash situation of your beauty salon is usually different that your costs and revenue during a certain time period. The cash flow statement is a table that summarizes your cash movements following three main categories: Cash flows from operations, cash flows from investing activities and cash flows from financing activities.

The statement of cash flows is very important because it gives you a clear picture of how your beauty salon is able to generate and consume cash. The higher your free cash flows, the better.

Beauty Salon Financial Plan: Balance Sheet

Let’s talk now about the third major financial statement called the balance sheet. This table summarizes the assets and liabilities of your beauty salon at a certain point in time. A balance sheet can be prepared monthly, quarterly or yearly.

In the asset column, you will find listed all your beauty salon’s assets categorized into short term and long term assets. Example of short term assets include cash, cash equivalents, account receivables…etc. Long term assets comprise property and equipment and other capital items such as cars, vans…etc.

On the liabilities column, you will find short term liabilities such as accounts payables and long term liabilities such as bank loans for example. You will also find a section called equity which comprise the capital contributed by the partners as well as the retained earnings (the part of the net income that was re-invested in the business).

The balance sheet is based on the following equation:

Assets = Liabilities + Equity

Both columns should be balanced and have the exact same total.

Conclusion

We hope you enjoyed this guide that shed light on the key financial considerations that matter for a beauty salon project. If you are serious about developing a solid financial plan in a fast and convenient way, then we also recommend you check out our ready-made beauty salon business plan with automatic financials. This comes with an Excel financial model tailored to the beauty salon business and that you customize easily.