Are you looking to start a B&B? If yes, then you need to develop a detailed bed and breakfast financial plan. In fact, understanding and projecting your B&B financials is probably the single most important activity you should be doing right now to gauge the size and profitability of your project.

What’s more, if you plan to get on board an angel investor or any financial sponsor, a detailed and robust bed and breakfast Excel financial plan is a must in addition to your B&B business plan document, to make a strong case.

We understand that creating a detailed B&B financial plan is no easy task, especially if you have no previous financial background or experience in financial modeling. But worry not, the aim of this article is to make things easier for you by cutting through the complexity and showing you what are the most important elements to keep in mind.

Bed and Breakfast Financial Plan Excel Template

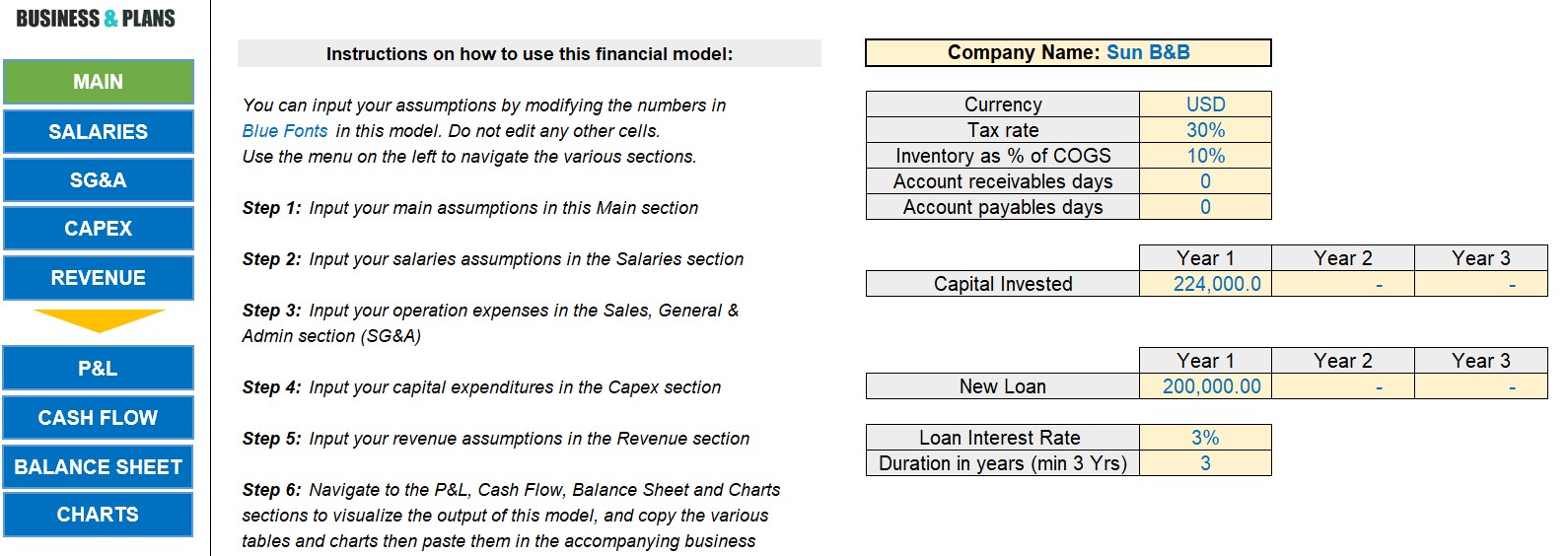

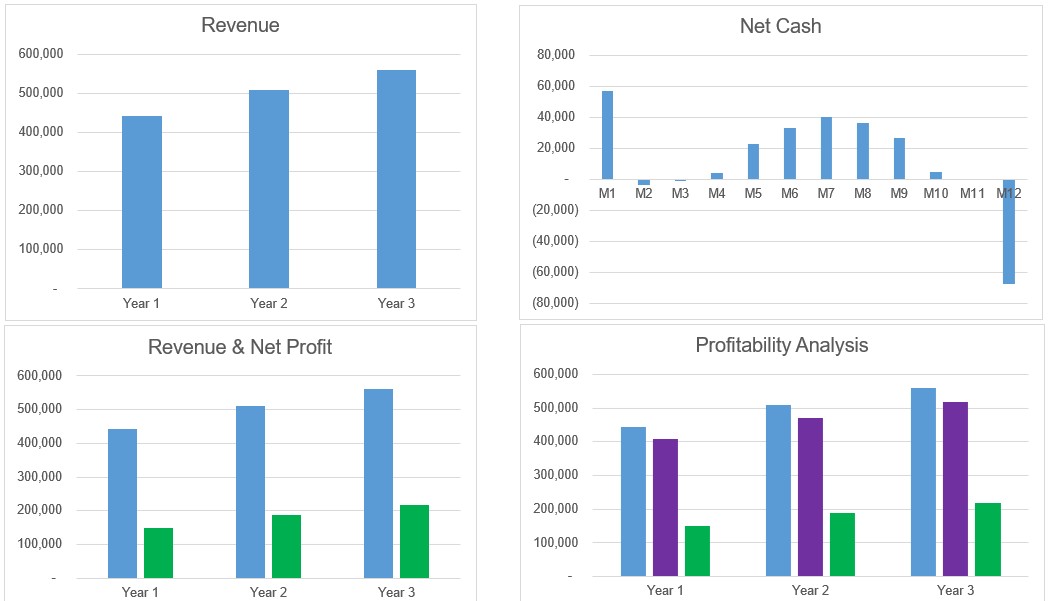

Before we dive in our detailed guide that explains what to include in your Bed and Breakfast financial plan, you might be interested to check our ready-made Bed and Breakfast Business Plan Template that includes an automatic and fully customizable pro-forma financial model in Excel tailored to the Bed and Breakfast business. Below are a couple of screenshots to give you an idea.

You don’t need any advanced accounting or financial knowledge to use or understand the Excel financial plan, all you have to do is adjust a few cost and revenue assumptions to fit your own B&B project and the model will automatically generate key financial statements including Profit & Loss statement, Cash Flow statement and Balance Sheet, in addition to a number of important charts and tables that you can later paste in your Bed and Breakfast business plan.

Without further delay, let’s see what are the main sections of a winning bed and breakfast financial plan.

Bed and Breakfast Financial Plan: Costs Forecast

Let’s start by looking at the costs involved in starting a B&B project. As you may have heard, costs are usually divided between the direct cost of service (or cost of goods sold in case your business is about selling products rather than services) and indirect operating costs. In the case of a bed and breakfast, the direct cost of service includes all the expenses directly linked to the offering, namely the cost of food, beverage and consumables (such as soap, shampoo, tissue, toilet paper…etc.) provided as part of the room rentals service. Some B&B managers also include the commission fees paid to booking agents as these expenses are directly linked to the service rendered.

These costs are usually variable because they vary based on the number of patrons, the occupancy rate and the seasonality of the business.

On the other hand, indirect operating expenses of a bed and breakfast business include costs that are rather fixed such as the rent in case the property is rented, staff salaries, utilities, marketing expenses…etc. These expenses tend to recur on a monthly, quarterly or yearly basis and are more predictable than variable costs.

Bed and Breakfast Financial Plan: Capital Expenditures

Now what about the cost of purchasing the guest house itself for example? If you plan to buy a B&B property rather than renting one and open it to the public, then this is considered a capital expenditure. In fact, all investments in fixed assets such as land, properties, vehicles, furniture, kitchen equipment and other similar items are usually capitalized rather than expensed. This means that these expenditures are actually considered as assets rather than liabilities for the business. Their depreciation however is accounted as an expense in the profit and loss statement.

Make sure you always distinguish these capital expenditures (also called Capex) from operating expenses (Also known as Opex).

Bed and Breakfast Financial Plan: Startup Costs

To understand your B&B startup costs, you need to list all the expenses you may incur before launching your guest house. These may include:

Licensing fees, cost of furniture and equipment, cost of landscaping, branding and website development fees…etc.

In case you plan to invest in a property rather than rent one, you need to include this expenditure (or at least the initial deposit) as part of your startup costs too.

Your startup costs usually determine the initial capital you need to set aside to start. However, most entrepreneurs raise an even higher amount of funding in order to finance the first few months of operations and ensure a comfortable launch.

Bed and Breakfast Financial Plan: Revenue Forecast

Now that we have seen the main costs involved in starting a bed breakfast, let’s have a look at sales and revenues but a side note first: While costs are usually fairly easy to predict, revenues are usually harder to model because you simply cannot know in advance how many reservations your guest house might get, especially not in the beginning at least.

But fear not! This is where a thorough market analysis is handy. By understanding your specific market dynamics in terms of trends, customer demand and seasonality, you can make educated assumptions to gauge your occupancy rates during various seasons of the year. For example, your B&B might be located in a summer holiday area where there is clearly a high season (from May till end September) and a low season (from October till April). During the high season, your occupancy rate will tend to be high and even reach full capacity during the peak months of July and August while in the low season, it might drop to below 50%. You get the idea.

Now that you have estimated your monthly occupancy rate, you can simply forecast your average revenue from room rental by assuming an average room rate (depending on the season as well).

While modeling your revenue, don’t forget to also include booking add-ons and extras such as meals, weddings, private parties and events…etc. These additional revenue streams can add up to a substantial amount and should not be overlooked.

Bed and Breakfast Financial Plan: Income Statement or Profit & Loss

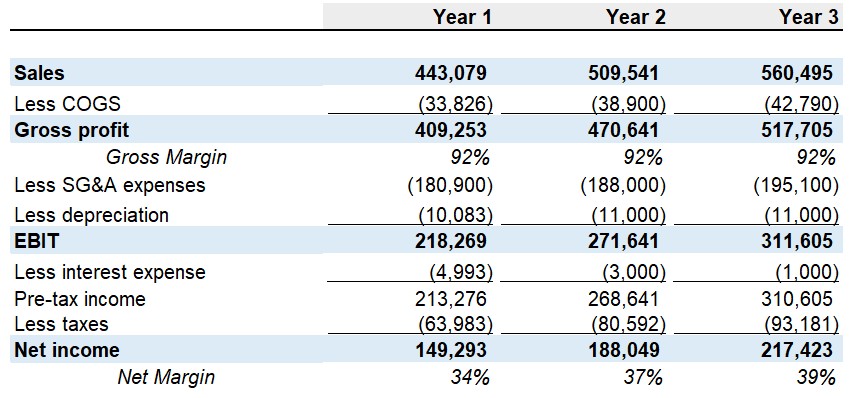

By using our Bed and Breakfast Financial model included with our premium B&B business plan template, you don’t need to worry about building an income statement from scratch. This financial statement is automatically generated once you edit your cost and revenue assumptions, hassle-free.

One of the main financial statements investors focus on is the profit and loss (or income statement) forecast. Guess what? This should also be YOUR main focus if you are serious about understanding the profit potential of your upcoming bed and breakfast project.

So, what is the B&B profit and loss statement or simply P&L?

You can think of the P&L as a simple equation: Revenue – Costs = Profit (or Loss).

It is a table that lists your revenue items from which you subtract your direct costs, your operating costs, your depreciation, your financing costs (for example interest rate) and your taxes. You end up with your net profit.

The net profit is the actual value your bed and breakfast has generated over a period of time. This is what you and your partners will share as dividends and as a return on your investment. When it is positive and significant, this means your B&B is thriving. When it is negligible or even negative, this means your operations need improvement in order to turn profitable.

But don’t confuse net income with cash flows. They are two different things. Sometimes a negative net income can still mean a positive cash flow and vice versa. More on that in the next section.

Bed and Breakfast Financial Plan: Cash Flow Statement

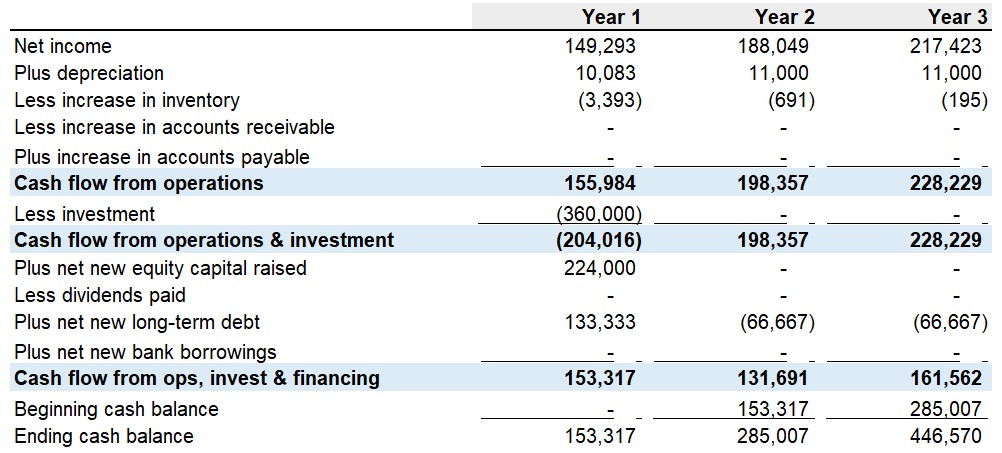

If you use our Bed and Breakfast Financial plan in Excel included in our premium Bed and Breakfast Business Plan package, you will be able to automatically generate a detailed cash flow statement after updating your cost and revenue assumptions.

You bed and breakfast business will always incur cash outflows and receive cash inflows over a certain period of time. Cash inflows happen every time you receive money in your company bank account in the form of checks, wire transfers, online card payments or actual cash. These cash in-flows usually come from sales invoices paid, online booking fees or even the sale of a used asset (for example your old company car).

Cash outflows occur every time your B&B bank account pays money to third party suppliers, pays salaries and rent among other things.

It is important to distinguish between a cash inflow and a sales invoice. A sales invoice is usually registered on your B&B income statement at the invoice date while the cash inflow is registered on your statement of cash flows at the actual invoice payment date, ie, when your bank account actually receives the money. For bed and breakfast businesses, the invoice date usually coincides with the payment date as customers pay upon check-out or in advance in case of an online booking. But for many businesses, it is not uncommon to have a time difference between the invoice date and the payment date. For example, a management consulting firm may get paid a long time after invoicing its client, typically after the project is completed and handed over.

Similarly, it is important to distinguish between a cash outflow and a liability. For example, it is common for B&B businesses to pay their F&B suppliers 30 days after receiving the invoice. In that case, a liability is registered in the P&L upon reception of the supplier invoice while a cash outflow is registered in the cash flow statement a month later.

So, in a nutshell, the total movement of cash inflows and cash outflows over a certain period of time is summarized in your bed and breakfast cash flow statement.

This table usually has three sections: cash flows from operating activities, cash flows from investing activities and cash flows from financing activities.

This statement is very valuable for investors who care about the cash generation potential of a business.

Bed and Breakfast Financial Plan: Balance Sheet

By using our Excel Bed and Breakfast Financial plan included in our premium Bed and Breakfast Business Plan package, you will be able to automatically generate a detailed balance sheet after updating your main cost and revenue assumptions.

You have certainly hear about the third financial statement called Balance Sheet. This is a summary of your Bed and Breakfast’s assets and liabilities. It is based on another simple formula that says:

Assets = Liabilities + Equity

Typical assets your B&B business owns are long term assets (example: the property itself, the furniture, cars, equipment…etc.) and short term assets (cash and cash equivalent, account receivables…etc.).

Typical liabilities of your B&B business include short-term liabilities (example: accounts payable, bank overdrafts…etc.) and long term liabilities such as bank loans or bonds.

Finally, your equity consists of the capital injected at the start of the business plus any past retained earnings.

Bed and Breakfast Financial Plan: Conclusion

Now that we have seen together the fundamental elements of a powerful bed and breakfast financial plan, you should feel more confident building solid financial projections for your B&B project.

In case you wish to save time and money, we highly recommend you download our automatic Bed and Breakfast financial plan template in Excel included in our ready-made Bed and Breakfast business plan package. It allows to create a robust financial forecast for your Bed and Breakfast fast and easy and no financial expertise is required on your part. You also receive a full and pre-written business plan tailored to the Bed and Breakfast business.