Starting a wedding venue business is a unique opportunity to create something special, but success doesn’t come without a solid financial plan in place. Your wedding venue financial plan is your roadmap to success, guiding your decisions and helping ensure the long-term viability of your project.

In this article, we’ll delve into the crucial components of a comprehensive financial plan for a wedding venue business, including cost forecasts, capital expenditures, startup costs, revenue projections, break-even analysis, profit and loss forecasting, cash flow statement and balance sheet. We’ll provide you with the tools you need to understand the financial landscape of your business, making informed decisions that support growth and success.

Just as a great builder starts with a solid foundation, a great wedding venue business starts with a solid financial plan. This article will serve as your foundation, providing all the information and guidance you need to create a plan that supports your project for the long term. So whether you’re just starting out or looking to take your wedding venue to the next level, read on!

Wedding Venue Financial Plan Template in Excel

Before we start, we recommend you check our automatic Wedding Venue financial plan in Excel included in our Ready-Made Wedding Venue Business Plan package. This is an off the shelf and cost-effective solution in case you don’t have the time to create a financial model from scratch. We have already done all the hard work on your behalf. All you need to do is change a few assumption in our wedding venue financial spreadsheet in Excel and the model will automatically generates an P&L, Cash flows and Balance sheet forecast for your project in addition to several beautiful charts and tables that you can easily paste in our pre-written business plan in Word (Yes, it also comes with an off the shelf business plan document that you can easily customize as well). For more information, check out our Wedding Venue Business Plan Template with Financials.

Without further delay, let’s crack on.

Wedding Venue Financial Plan: Cost Forecast

The first crucial step is to understand the cost structure in a wedding venue business. This includes the cost of goods sold (COGS) and the operating expenses (Opex).

COGS includes the direct costs associated with running the wedding venue, such as food, beverages and supplies needed for each event. These expenses should be accurately forecasted and regularly tracked to ensure they are in line with the budget. For instance, supplies will vary depending on the type and quantity of consumables required for each celebration. It’s important to factor in the cost of both one-time and recurring supplies, such as candles, flowers and decorations.

Understanding Your Wedding Venue’s Monthly Expenses

Opex refers to the ongoing expenses necessary to keep the business running and these “overhead” costs can vary greatly depending on the size and location of the venue and the level of service offered.

It is important to consider the following costs in the Opex forecast:

- Rent (or mortgage interest payments in case of ownership): This is likely the largest expense for a wedding venue business and should be based on market rates for similar properties in the area. This cost may increase over time due to inflation (or interest rate hikes in the case of a mortgage), so it’s important to factor in annual increases in the forecast.

- Utilities: This cost will vary depending on the size of the venue, the number of events held and the time of the year. It’s always a good idea to research utility rates in the area and budget for both regular and peak usage.

- Salaries: The cost of staffing will depend on the number of employees needed to run the wedding venue, their hourly wages and any benefits offered. It’s also important to also include the cost of hiring and training new employees, as well as the cost of uniforms and personnel equipment.

- Marketing & advertising: This may include print or online advertising, email marketing, commissions on referrals from agents and social media campaigns. Make sure to allocate a budget for ongoing marketing efforts to maintain visibility and attract new customers.

- Maintenance: This cost will vary based on the frequency and type of maintenance needed. Think for example about the funds needed to fix some old sound system or to maintain your HVAC system. As a side note, investing in the equipment themselves (e.g. a new sound system) does not fall under Opex but rather under CapEx; more on that in the following section.

- Legal and Insurance costs: These services (and related expenses) are important for this type of business so make sure to find the best deal for your wedding venue project.

By carefully estimating and tracking both COGS and Opex, a wedding venue business can create a realistic financial plan that will ensure its long-term success.

Wedding Venue Capital Expenditures

Capital expenditures (CapEx) refer to the funds you invest in long-term assets or improvements that will benefit your business over several years. In the context of a wedding venue business, CapEx typically includes:

- Building or venue purchase: You may decide to purchase a property rather than renting one. In that case, the venue itself will be considered as a Capital Expenditure rather than an expense.

- Major renovations or improvements: This could include remodeling or upgrading the venue space, installing new lighting or flooring or adding amenities like a bridal suite or outdoor patio. These expenditures can improve the guest experience and increase the value of the wedding venue over time.

- Equipment purchases: This includes buying or upgrading kitchen equipment, sound systems, security systems or other event-related technology.

- Vehicles: If the business operates a fleet of vehicles for transportation or delivery purposes, these can also be considered capital expenditures.

- Technology upgrades: Upgrading software or hardware to improve operational efficiency and enhance the guest experience can help the wedding venue remain competitive and relevant in an ever-changing market.

When planning for capital expenditures, it’s important to consider the following:

- Cost estimates: Establishing a budget for each project, based on vendor quotes or industry standards, will help the business determine how much it needs to invest and when. This information can inform funding decisions and help the business prioritize Capital expenditures.

- Funding sources: Businesses may use a combination of debt financing, equity financing or internal funds to finance capital expenditures. The best funding option will depend on the size and timing of the expenditures and the business’s overall financial situation.

- Project prioritization: Businesses should prioritize expenditures based on the potential return on investment, impact on the guest experience and the long-term impact on the venue’s competitiveness.

- Timing: CapEx investments should be timed to align with the business’s growth plans ensuring that they are made when they are most needed.

Wedding Venue Financial Plan: Startup Capital

Startup capital refers to the funds a wedding venue requires to get up and running, covering costs such as venue rental (or purchase), equipment purchases, marketing and staffing. The amount of startup capital required will depend on the size and scope of the venue, as well as the local market conditions.

Some of the key figures you need to cover include rent (or initial deposit if you plan to buy the venue and get a mortgage), equipment and supplies, marketing and ad budget (for the initial launch phase), up to 6-12 months salaries and working capital (this is a reserve of funds used to cover the venue’s operating expenses until it begins to generate positive cash flow).

It’s important to note that the amount of startup capital required will vary depending on the specific circumstances of your wedding venue business. A business plan should be developed to estimate the capital required and inform funding decisions. This can help ensure that your venue has the resources it needs to launch and succeed.

Revenue Forecast for a Wedding Venue

The next step is to model your wedding venue’s revenue. This process involves estimating the amount of sales you can expect to generate in the future based on various assumptions, such as the number of events held, the average price per event and the occupancy rate.

The number of events held at your wedding venue will depend on multiple factors such as the venue’s capacity, local market demand and your marketing efforts. It’s also important to take into account the type of events that you will host, such as weddings, corporate events, and other events, as this will impact the overall revenue.

The average price per event is another crucial factor in forecasting your revenue. This is the average revenue generated from each event, taking into account the type of event (private or corporate), the services provided and the pricing structure. Factors such as the catering cost and the décor and entertainment expenses will surely impact your venue’s overall profitability. Additionally, make sure not to forget any discounts or promotions that your may offer, as these will impact the average price per event.

Now let’s talk about the occupancy rate. This is the percentage of the venue’s capacity that is used for events. A higher occupancy rate will result in higher revenue, while a lower occupancy rate will result in lower revenue (especially if you price per guest). Always consider the venue’s capacity utilization when forecasting revenue, as this determines the number of events that can be held simultaneously as well as the average price per event.

Next, let’s discuss seasonality which is another major factor to consider when forecasting the revenue of a wedding venue. The demand for wedding and events experience fluctuations throughout the year, with some seasons being busier than others. For instance, summertime may be the peak season for weddings especially in regions with a nice weather in the summer. Conversely, wintertime is probably not the best season for weddings. Of course, this varies depending on geographical location of your venue but in all case make sure to take the seasonality into account when forecasting your revenue.

Here are additional factors you should also take into account when estimating your revenue:

- Event Types: For example, weddings typically generate higher revenue than corporate events. It’s important to consider the mix of events held at the venue and how this will impact your revenue.

- Packages: Your venue may offer different event packages with varying prices and services. This should be taken into account when forecasting your revenue, as it will impact the average price per event.

- Marketing Efforts: Your marketing efforts will impact the number of events held at the venue, and therefore, the revenue generated. Marketing efforts should be factored into the revenue forecast, taking into account the cost of marketing and the expected return on investment.

- Economic Factors: The local economy and the overall state of the wedding industry will impact the venue’s revenue. For instance, a recession may reduce demand for weddings while an economic boom may result in increased demand.

- Competition: Competition from other wedding venues in the local market will impact the venue’s revenue. It’s important to keep an eye on the competition, and how their pricing strategies, marketing efforts, and event packages may impact your own business and revenue.

To conclude this section, remember that a comprehensive revenue forecast should be based on realistic assumptions and informed by market research, competitive analysis and other relevant data.

Break Even Analysis for a Wedding Venue Business

The break-even analysis is a key tool for a wedding venue business to determine when its revenue will cover its expenses, marking the point at which the business begins to generate a profit. By understanding the break-even point, you can better plan your finances and make informed decisions about growth and expansion.

Let’s take an example to illustrate the components of a break-even analysis for a wedding venue:

- Total Fixed Costs: For example your total fixed costs could be $15,000 per month, including rent, utilities, insurance, and other recurring expenses.

- Variable Costs: Variable costs such as food and beverage costs, staffing and marketing costs would change based on the type and size of the event held at the venue. But let’s assume an average of $5,000 in variable costs per event based on your historical data.

- Average Revenue per Event: Let’s also assume an average revenue of $10,000 generated from each event held at your venue.

- Break-Even Point: By dividing the total fixed costs of $15,000 by the difference between the average revenue per event of $10,000 and the average variable cost per event of $5,000, we can calculate the break-even point as three events. This means the venue must hold at least three events per month to cover its costs and generate a profit.

- Impact of Changes: By understanding the break-even point, you can assess the impact of changes to the financials, such as a change in prices, costs or event mix. For example, if you increase the average revenue per event to $12,000, the break-even point would decrease to about two events per month.

Wedding Venue Income Statement Forecast

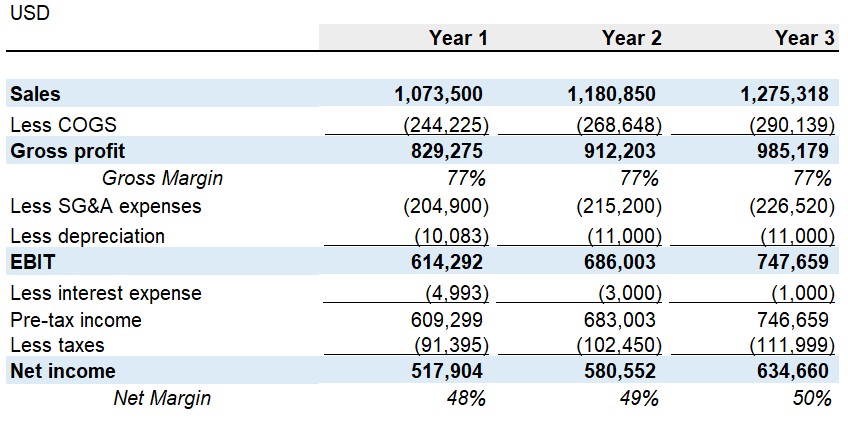

A Profit & Loss (P&L) forecast is an essential tool for a wedding venue business to estimate its expected revenue, expenses and profits over a specified period of time. Here are the key components of a P&L forecast for a wedding venue business:

- Revenue: As discussed above, this includes all income generated through venue rentals, food and beverage sales and any other sources.

- Cost of Goods Sold (COGS): As already seen, COGS refers to the direct costs associated with producing the goods or services the venue offers, such as food and beverage expenses and supplies.

- Operating Expenses: These include indirect costs such as salaries, marketing, utilities and other overhead expenses. Staffing costs should include the cost of hiring, training and maintaining a competent and professional team, while marketing expenses should cover the cost of promoting the venue to potential customers. Other overhead expenses should include the cost of utilities, insurance, and other recurring costs associated with running the venue.

- Gross Profit: Gross profit is calculated by subtracting the COGS from revenue. Gross profit provides a useful indicator of the venue’s profitability and helps in making informed business decisions.

- Net Profit: Net profit is calculated by subtracting the operating expenses from the gross profit. Net profit is the final indicator of the venue’s financial performance and provides an estimate of the profit that will be available to reinvest in the business or distribute as dividends. The Net Margin (Net Profit divided by Revenue) is an important financial ratio you should compute and track on a regular basis. A high net margin is an indicator of a strong business performance.

By creating and regularly updating a P&L forecast, you can monitor the financial performance of your wedding venue, identify areas for improvement and make informed decisions that drive growth and success.

Wedding Venue Cash Flow Forecast

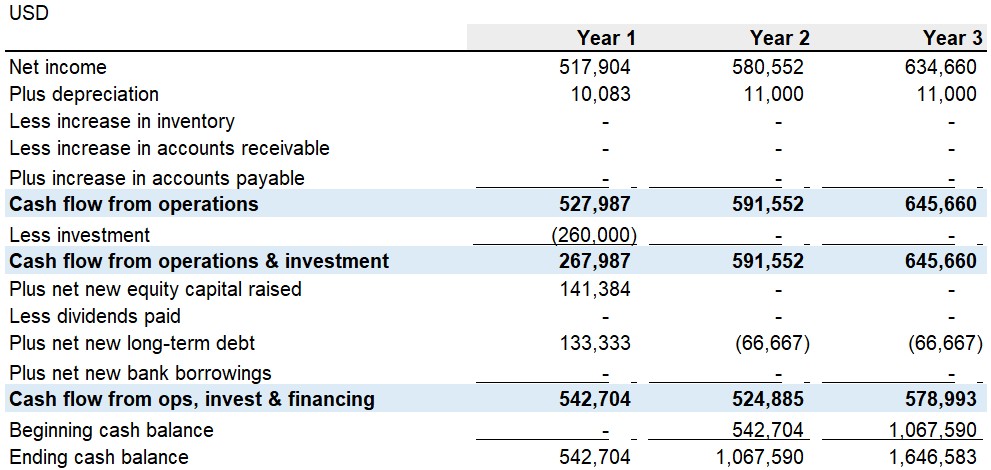

Here are the key components of a cash flow statement for a wedding venue business:

- Cash Inflows: This includes all sources of cash entering the business from your sales. It is important to accurately estimate the amount of cash that will be generated from each event and the timing of these inflows.

- Cash Outflows: This includes all payments made by the business, such as staff salaries, advertising expenses and the cost of goods and supplies.

- Operating Activities: Operating activities represent the cash inflows and outflows associated with the day-to-day operations of the wedding venue. This section should provide a clear picture of the net effect of the venue’s operating activities on its cash balance over a specified period of time.

- Investing Activities: These represent cash inflows and outflows linked to the investments made by the business, such as the purchase of property or equipment.

- Financing Activities: Activities associated with the business’s financing arrangements, such as loans, equity investments or payment of dividends make up this category of cash flows.

- Net Cash Flow: Net cash flow is calculated by subtracting the total cash outflows from the total cash inflows. Net cash flow provides an estimate of the change in the venue’s cash balance over a specified period of time.

It is important to regularly update the cash flow statement to ensure it remains accurate and relevant. By monitoring cash inflows and outflows, the venue can ensure it has sufficient cash to meet its financial obligations.

Wedding Venue Balance Sheet

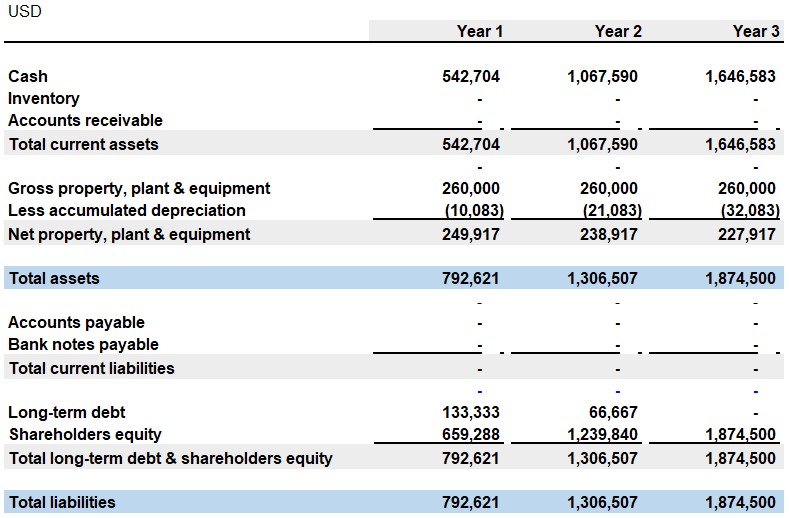

A balance sheet is a snapshot of your wedding venue’s financial position at a specific point in time. It provides a clear picture of the business’ assets, liabilities and equity and is an essential tool for monitoring the general financial health.

Here are the key components of a balance sheet for a wedding venue business:

- Assets: Assets are resources that the business owns and has the potential to generate future economic benefits. This includes items such as cash, investments, property and equipment.

- Liabilities: Liabilities are obligations owed by the business, such as loans, accounts payable, and taxes owed. It is important to accurately estimate the amount of these obligations and their expected repayment date.

- Equity: Equity represents the net worth of the business after deducting liabilities from assets. This includes items such as owners’ capital, retained earnings and any other equity contributions.

Regular updates to the balance sheet ensure it remains accurate and relevant, providing valuable insights into the business’s financial performance and position.

Wedding Venue Financial Plan: Final Thoughts

We have reached the end of our guide. Remember, a financial plan is a critical component of any successful wedding venue business. From cost forecasts to balance sheets, each element of your financial plan provides valuable insight into the financial health and future of your business.

By taking the time to create a comprehensive financial plan, you’ll have the tools you need to succeed, and as we mentioned above, you can even purchase our automatic financial plan included in our ready-made wedding venue business plan template – This option is guaranteed to save you a lot of time, effort and money.

Whether you’re just starting out or looking to take your business to the next level, a well-structured financial plan can help you achieve your goals. So don’t wait, start putting together your financial plan today, and see the difference it can make for your wedding venue business. With this in place, you’ll be well on your way to creating a successful, thriving wedding venue that makes your dreams a reality.